Top 25 Management Reporting Best Practices To Create Effective Reports

Table of Contents

1) What Is A Management Report?

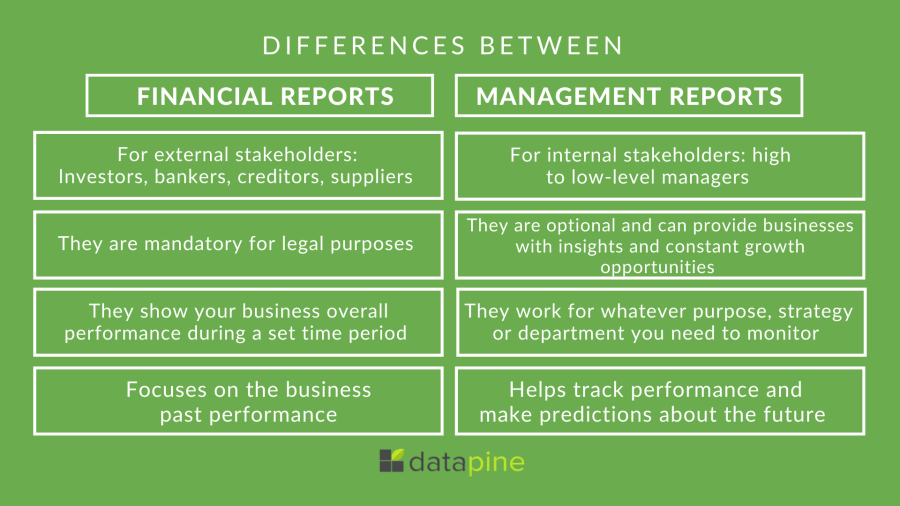

2) Financial vs. Management Reports

3) Management Reporting Best Practices & Examples

4) Management Reporting Trends & History

5) Importance Of Management Reporting

6) Types Of Management Reports

Management reporting is a source of business intelligence that helps business leaders make more accurate, data-driven decisions. But, these reports are only as useful as the work that goes into preparing and presenting them. In this blog post, we’re going to give a bit of background and context about performance management reports, and then we’ll outline 25 essential best practices you can use to be sure your reports are effective.

We’ll also examine examples that illustrate these practices in action created with modern online reporting tools. By the end of this article, making stunning and useful managerial reports will be second nature to you. But before we get into the nitty-gritty, let’s start with the basic definition.

What Is A Management Report?

Management reports are analytical tools used by managers to inform the performance of the business in several areas and departments. Senior executives and leadership use management reporting to drive their strategic decisions and monitor critical KPIs in real-time.

They basically show the worth of your business over a specific time period by disclosing financial and operational information. Reporting for management provides insights into how the organization is doing, empowering decision-makers to find the right path to increase operating efficiency and make pertinent decisions to remain competitive. To do so, many companies use professional management reporting software.

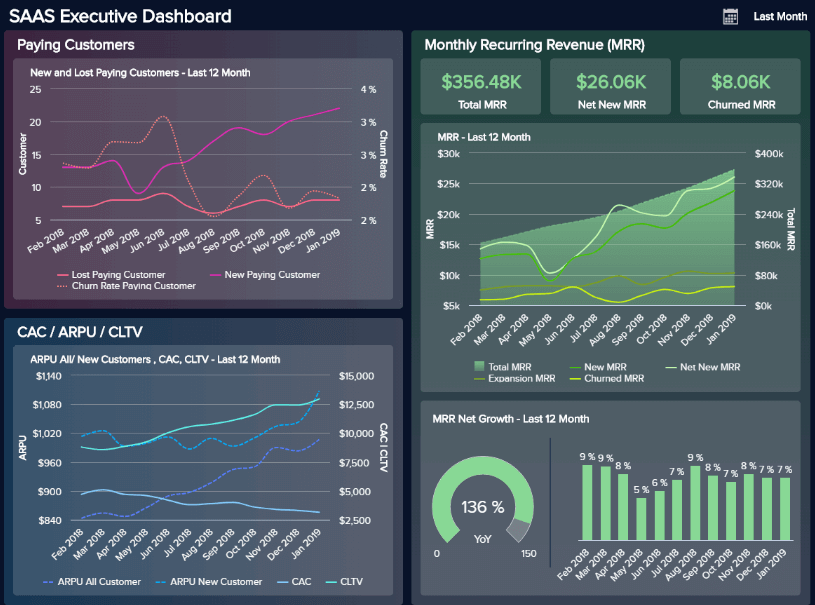

Backed up with powerful visualizations developed with a dashboard creator, no information can stay hidden, eliminating thus the possibility of human errors and negative business impact. The image above is a management report example focusing on a SaaS business. Throughout this post, we will cover various examples for different industries and departments to help you understand the power of these modern tools.

In The Beginning, Financial Reports

Most people in business are familiar with financial reports, which your business is required to keep for external accounting purposes. These reports are generally put out “after the fact” and follow a very clear and established set of guidelines known as Generally Accepted Accounting Principles (GAAP).

While such reports are useful for legal purposes, they’re not ideal for decision-making. They give you a bird's eye view of your business operations but without the actionable insights that are useful for making strategic choices. They’re also slow. As Tyrone Cotie, treasurer of Clearwater Seafoods, said, “…no matter how quickly you compile and release historical financial statements, you never make a decision from them. The challenge for finance is getting timely and accurate analysis that’s forward-looking and helps us make decisions.” This statement is valid today and probably, in the future as well. Why?

Because this mismatch between usefulness and reality comes from the fact that financial reports were never designed to be useful: they were designed to satisfy legal requirements. They were using historical data only.

Trying to make financial management reports useful

The mentioned mismatch led some companies to try to use their financial reports for legal purposes as decision-making tools by including additional information in them. While this approach has some merit, it has one big drawback: increased complexity and time cost. Considering that financial reports have to hit specific legal deadlines and that any additional information will cause them to be prepared in a more time-intensive way, this approach of “hybridizing” financial reports into management + finances is not recommended. Thus, the practice of management reporting separately from financial reporting came about. Managerial reports use a lot of the same data as financial ones but are presented in a more useful way, for example, via interactive management dashboards.

As a Growthforce article states, management reports help answer some of the following questions for a CEO:

- “Am I pricing my jobs right?

- Who are my most profitable clients?

- Do I have enough cash for payroll?

- Should I hire more employees? If so, how much should I pay them?

- Where should I spend my marketing dollars?”

To answer these questions, you will need a financial management report focused not on legal requirements but on business-level and decision-making ones. In essence, analysis reports are a specific form of business intelligence that has been around for a while. However, using dashboards, big data, and predictive analytics is changing the face of this kind of reporting.

Before moving on to our list of best practices, we leave you an image to help you easily visualize the differences between these two types of reports.

**click to enlarge**

We offer a 14-day free trial. Benefit from great management reports!

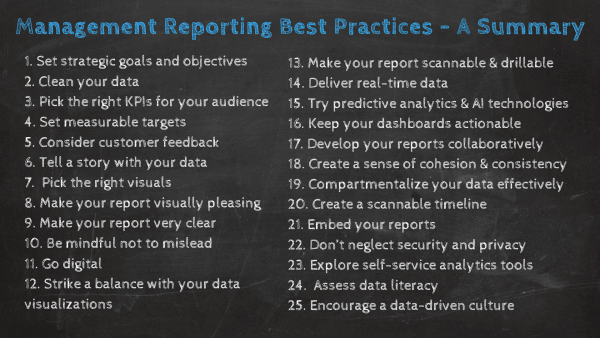

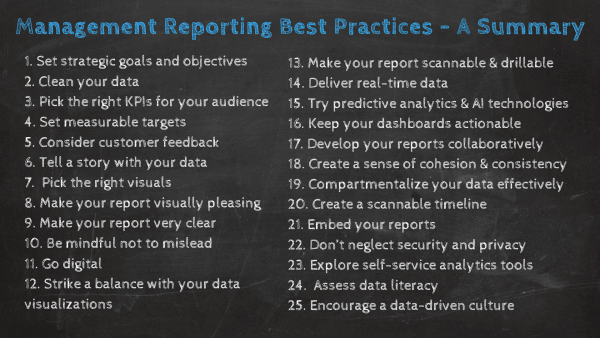

What Should Be Included In A Management Report: Top 25 Best Practices, Examples & Templates

We’ve asked the question: ‘What is a management report?’ and explored its clear-cut benefits. Now, it’s time to consider the management reporting best practices.

Here, we’ll explore 25 essential tips, looking at management reporting examples while considering how you can apply these principles to different types of managerial reports.

1) Set the strategic goals and objectives

For every report you write, you will need to start with the end in mind. Why do you need that report in the first place? Do you know the key drivers of your business? How can you tell if your pricing is correct? How do you define success? Ask yourself some important data analysis questions that will allow you to address the needs of the report.

Once you know what you are monitoring and why it will be much easier to set the performance indicators that will track each specific aspect of the performance, don’t go further in the reporting process until you have set at least two to three goals.

2) Gather and clean your data

After you’ve set strategic and operational goals for the organization, your next step is to collect the information needed to track the success and performance of your efforts toward achieving those goals. Now, an important point to consider here is to pick only the data that will assist you in tracking your goals. Businesses gather an infinite amount of information coming from customers, sales, marketing, and much more, and tracking everything can become overwhelming and counterproductive. Instead, pick the sources of data that you actually need and move on to the cleaning stage.

Once you have selected your sources, you must ensure your data is clean and ready to be analyzed. When we say clean your data, we mean erasing any duplicates, missing codes, or incorrectly formatted data that can damage your analysis in the future. If, just by reading this, you are thinking, “What a tedious process this must be,” it's because it is. Cleaning your data manually requires a lot of time and effort. That said, there are many online data analysis tools out there that automate this process to save you countless hours of work and prevent any risk of human error.

3) Pick the right KPIs for your audience

OK – so you know that you need to focus on a small number of KPIs. Which ones should you be putting on?

It really depends on your audience – both on their job function and their level of seniority. For example, a junior sales manager and a junior marketing manager are both going to want to see different indicators. And the junior marketing manager will be interested in different data than the head of marketing. Good KPI management is critical in the process of manager reporting. A good way to think about the challenge of picking the correct metrics is to think: what data-driven questions will the readers of this report want to be answered? A sales manager might be interested in which of his reps is performing better, while an inbound marketing manager might want to know which piece of content is performing better regarding new email signups. Only after answering this question you will be able to address your audience’s expectations and benefit from effective reporting. You can also read our KPI reports article, where you can find precious advice on how to pick your KPIs.

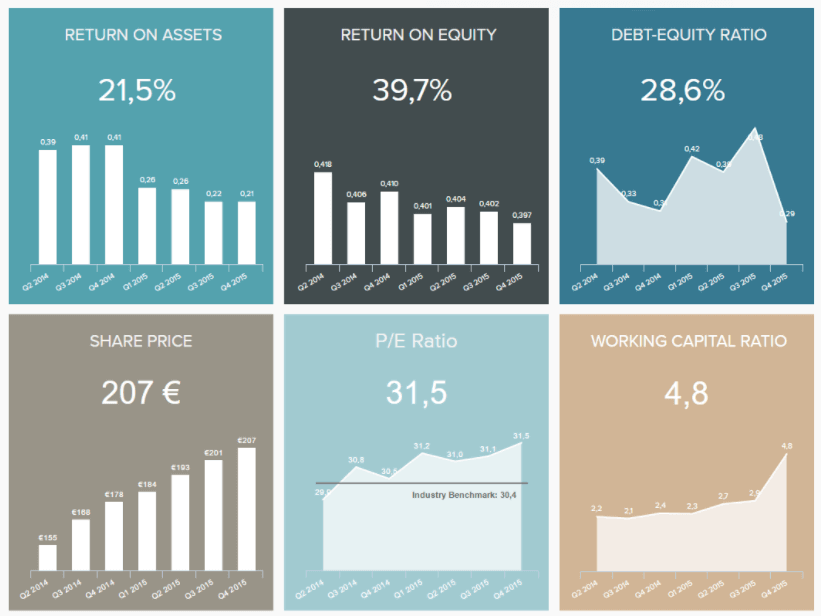

Hereafter is an investment management reporting format that illustrates this practice well. It focuses entirely on variables that investors would care about, including the share price and the price-to-earnings ratio.

**click to enlarge**

4) Set measurable targets and benchmarks

Once you’ve set your goals and defined the KPIs you’ll need to measure them, it is a good practice to set targets or benchmarks to evaluate your progress based on specific values. Let’s explore some ways in which you can define them in the most efficient way possible.

To do so, you first need to understand the difference between targets and goals. On one hand, goals are general strategic objectives that your company wants to achieve, such as increasing revenue compared to the previous year. And on the other hand, targets are the measures that will enable you to understand if you are on the right track to achieving your initial goals. Based on that, you should be able to set measurable, relevant, and achievable targets. Emphasis on achievable. Many businesses make the mistake of setting unrealistic targets and end up being disappointed when they don’t reach them. To prevent that from happening, comparing your performance to the previous period is a good and realistic benchmark to get started. Our example below is a CEO dashboard that gives managers a perfect overview of the organization’s performance compared to the previous period. Let’s talk about it in more detail below.

**click to enlarge**

The CEO template provides insights into 4 critical areas for any C-level executive: finances, sales and marketing, customer service, and HR. Each of the metrics displayed in this report is compared to a benchmark of the previous period, with the colors red and green showing negative or positive development, respectively. Through this, managers can understand if their strategies are performing as expected and quickly spot any issues or improvement opportunities.

5) Take customer feedback into consideration in your reports

An additional tip is to use customer service analytics to draw conclusions from your client's feedback. Customer feedback plays into the overall performance of an organization as it caters to the organization’s ability to meet the needs of its customers. This feedback not only helps teams gauge what they’re doing wrong on their digital channels but also what they’re doing right.

Reporting on insights from feedback surveys can aid in forming a more data-driven digital strategy. For example, it can be leveraged to inform your product roadmap, identify pain points across the website (usability), and boost overall customer satisfaction.

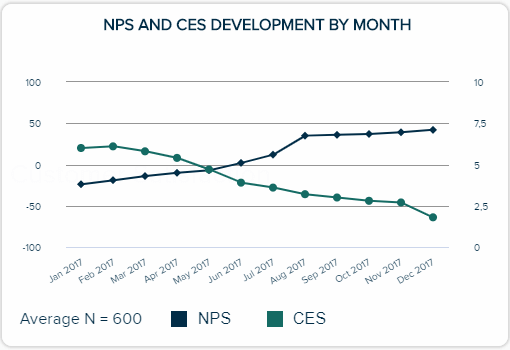

Is it overall customer satisfaction you wish to report on? Dive into your charts and show the rise (or fall) of your Net Promoter Score (NPS). Then take it one step further and analyze open comments associated with your scores to uncover what’s causing the drop. From here, you can formulate a strategy for boosting the organization’s NPS.

Here is an illustration of an NPS (feedback) chart:

6) Tell a story with your data

Our next tip zooms out of hard data and figures to focus more on the style and how to present your raw content. Human beings are primarily persuaded through 3 different types of information: context, content, and meaning. When you tell a story using the insights on your report, you can utilize all of them. This form of storytelling is challenging, but you have a few tools at your disposal and some tips:

- Using time periods and historical data. Stories follow a beginning, middle, and end pattern, and through the use of showing trends over time, you can achieve something similar. For example, you could compare the revenue in Q1 this year to the revenue in Q1 last year.

- Contrasting different KPIs and metrics against each other. For example, showing a target revenue number vs. the actual number this quarter.

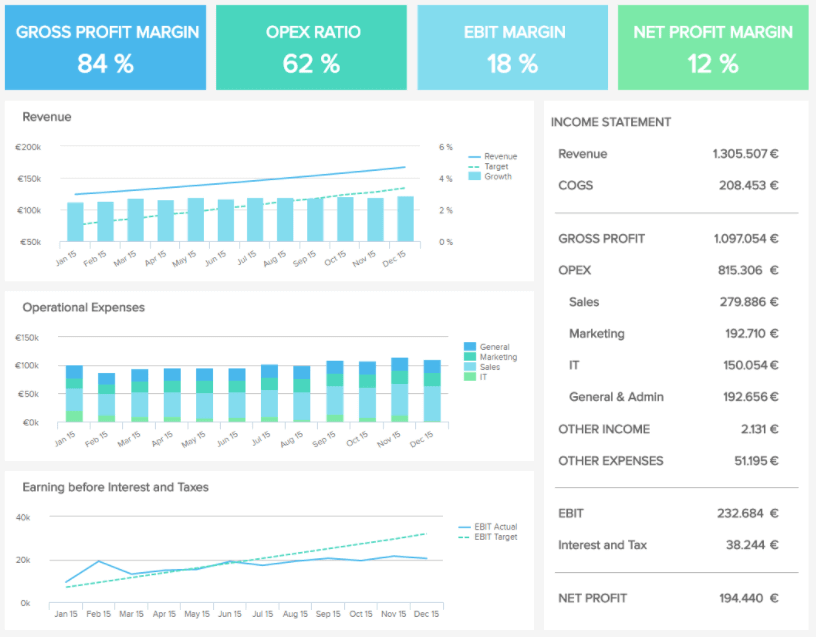

Hereafter is a good example of a management report, mainly thanks to the three large historical graphs taking up most of the display:

**click to enlarge**

Let’s take a real-world example of how you can selectively use metrics to tell a specific story: you are the head of marketing and need to justify your current expenditures on content marketing to the CEO. She doesn’t care about email signups or page visits. No, your CEO is interested in revenue and ROI (an essential element of any effective financial management report). It is your job to connect the KPIs you look at revenue so that your CEO understands how important funding your department is.

You could show her the following variables to tell a story:

- Current email list numbers compared to last quarter

- How many new email list signups you’re currently getting per week on average

- The average email list signups you got per week last quarter

- How much money are you making, on average, for every new email subscriber and calculate the expected ROI

Using all of this information, you can answer the following question: how much new revenue is being driven by your new content marketing strategy?

This is the kind of story that can make or break funding allocation for a department.

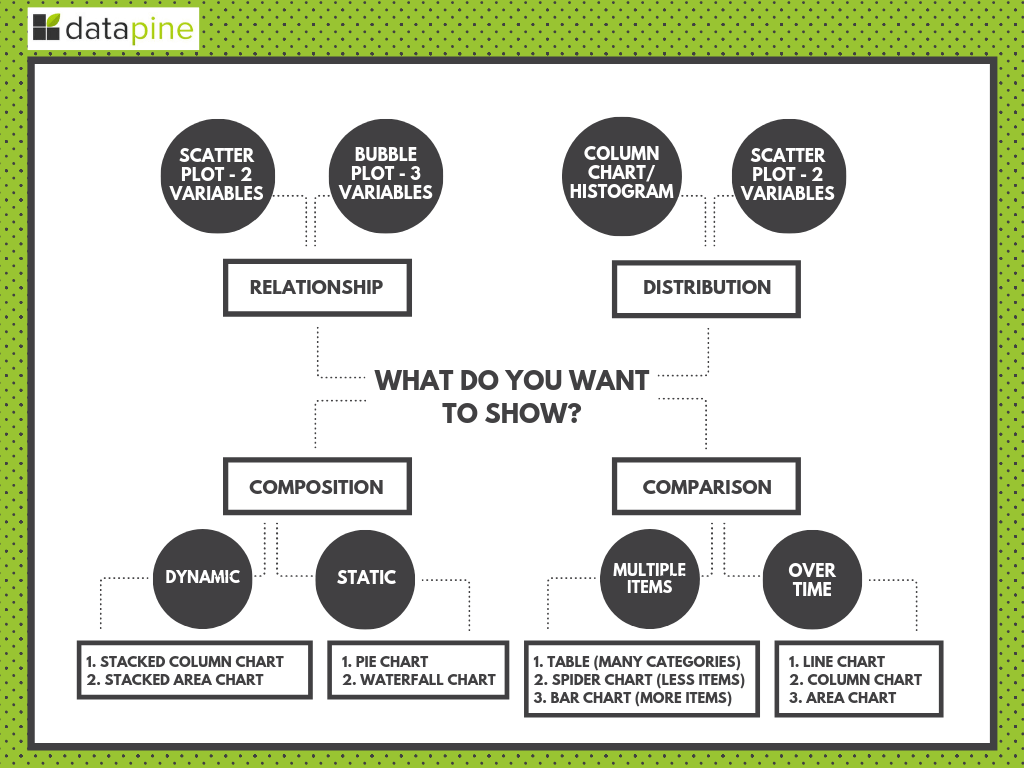

7) Pick the right visuals

If you ever dealt with analytics and reporting before, then you must be aware of the multiple types of graphs and charts available to visualize your most important KPIs and build your reports. That said, being aware that these graphics exist does not mean you have the knowledge of how to use them correctly. A common mistake when it comes to management reporting is to use the wrong visual. This can significantly harm the decision-making process as the data can be perceived in the wrong way.

The first step you should take to avoid this mistake is to think about the goal of the data you want to display. Are you trying to show the breakdown of total costs? Or comparing costs to a previous period? Understanding the end goal will enable you to pick the right visual to convey the information you want. To help you with this task, below we display a visual overview of the different types of graphs and charts you should use depending on whether you want to compare, find relationships, analyze distribution, or composition.

**click to enlarge**

If you want to dive deeper into this topic, our guide on the different types of graphs and charts will provide all the necessary knowledge and practical examples.

8) Make your report visually pleasing through focus

The human mind cannot process too much data at a time without getting overwhelmed. Getting overwhelmed leads to decision fatigue – which makes it harder for your management team to think strategically. That’s why when it comes to this level of reporting, you should remember the mantra of “less is more.” As a rough rule of thumb, displaying three to six KPIs on a report is a good range, and going too much beyond this is not the greatest idea.

That doesn’t mean that you can’t have other data presented – but you must have a clear hierarchy of visual importance in your report and only give the most important spots to your indicators. Other metrics should occupy secondary or tertiary positions. State-of-the-art online dashboard software allows you to easily build interactive KPI dashboards in no time that will become your prime asset when you’ll need to convey your information.

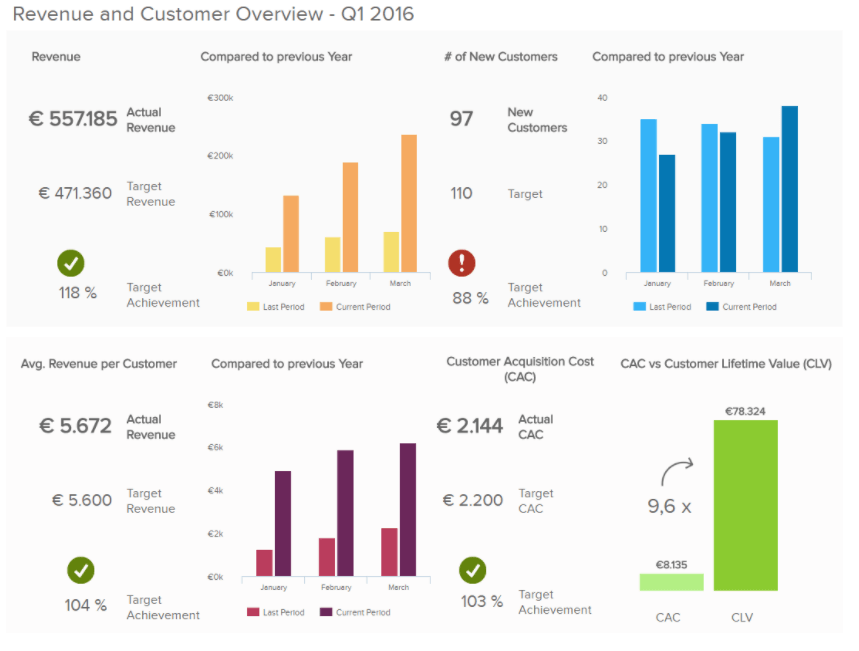

The following example is good to showcase this practice:

**click to enlarge**

The four KPIs in this report template are prominently displayed:

- Revenue

- Number of New Customers

- Average Revenue per customer

- Customer Acquisition Cost

These metrics are set in context with historical trends, targets for the period, or other metrics like Customer Lifetime Value, causing this focused graph to tell a story.

9) Make your report very clear

In business writing and management reporting, clarity is the primary objective. This has several implications for your report design:

- Follow established dashboard design principles – give plenty of white space, ensure your colors stand out from each other, and select colors carefully.

- Don’t forget the small things – display a date range next to the data, and ensure it’s clear whether a given KPI is good, bad, or neutral. A good way to do this is by comparing expected values to real ones, like the expected revenue for a quarter to the actual revenue of this very quarter.

- Use common metrics that everyone who will read the report can understand and has experience with using.

For more tips & tricks on data-efficient reporting, you can read one of our previous blog posts on how to create data reports people love to read.

10) Be mindful not to mislead

As you learned in our two previous points, making your reports visually appealing and following design best practices is a fundamental aspect of achieving a successful management reporting process. Another important aspect to consider in this regard is to be mindful of how the information is presented to avoid being misleading. As a manager generating a report, it is very likely that you will have a diverse audience which can include people that are not familiar with the data presented in them. For this reason, following some best practices to avoid misleading reports can help you keep your work objective and easy to understand.

- Labels: When integrating several charts and graphs into your reports, labels play a fundamental role in how the data is perceived. For this reason, your labels should be short, clear, and concise. Avoid writing labels that guide the viewer to a specific conclusion or too complicated ones that can make the chart hard to understand.

- Axis: Manipulating an axis is a common form of misleading statistics used by the media and politicians to manipulate the public. A common bad practice in this regard is to start the X axis in a higher number than 0 to exaggerate a comparison between two data points. To avoid this, use your axis correctly, following charting guidelines.

- Cherry picking: This means picking only the data that will make you look good. As a manager, you obviously want to show how great the business is doing. However, showing only good results is a practice that can mislead the audience into believing something that is not the complete truth. Including bad results is a good way to learn and find improvement opportunities.

We offer a 14-day free trial. Benefit from great management reports!

11) Go digital!

An important best practice for management reporting is to ditch paper-based reports and go digital. Online KPI reporting software is a great asset for your business, as they offer real-time updating capabilities, saves money, and reduces waste.

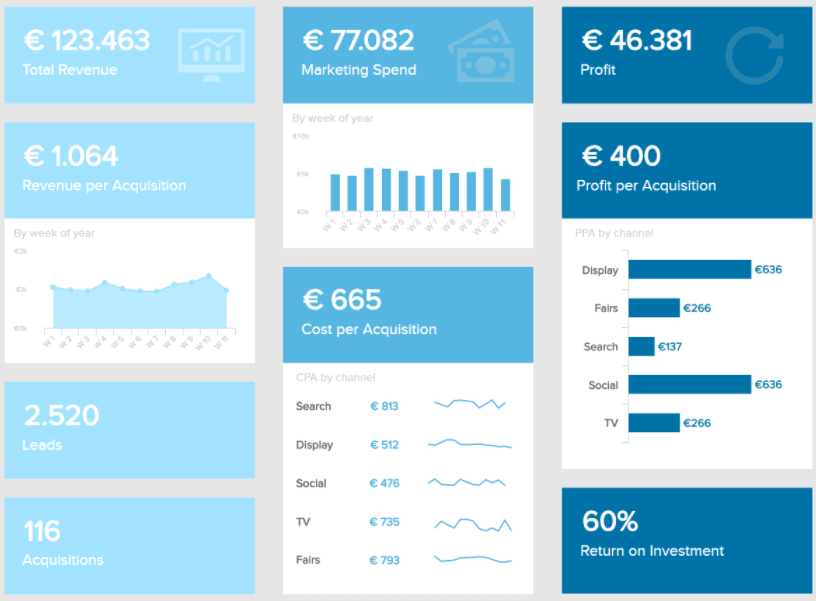

These digital reports can be made to be interactive, allowing you to get more granular or zoom out as you wish. Moreover, they are collaborative tools that let your team onboard the analytics train and work conjointly on the same report. Another example we will provide you with is the following marketing KPI report:

**click to enlarge**

This is the perfect type of report a management team needs to ensure actionable, data-driven decisions: a high-level overview of the marketing performance is given. Indeed, focusing on the click-through rate, the website traffic evolution, or page views wouldn’t make sense. On the other hand, the big picture of how the marketing department works as a whole will be more appreciated: total revenue generated standing next to the total spend, the profit that came out of it, the return on investment, etc.

12) Strike a balance with your visualizations

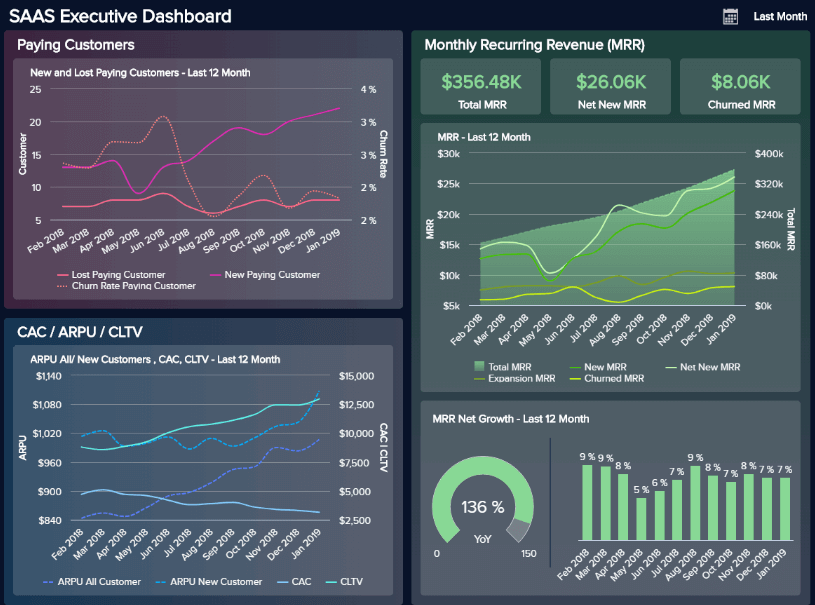

We’ve established that making your report clear is vital to success. Another way of making sure that your management report format is digestible is to make your various visualizations balanced on the page. Our SaaS executive dashboard is an excellent example of a visually balanced format:

**click to enlarge**

The primary focus of this particular example is to provide a customer-centric view of the costs, revenue, and performance stability of your SaaS-based activities from a senior standpoint.

As you can see, our SaaS executive dashboard serves up 4 performance indicators (Customer Acquisition Costs, CLV, ARPU, and MRR) to offer a concise snapshot for senior decision-makers, with each visualization selected based on their ability to offer at-a-glance information without clashing or creating confusion.

When choosing types of graphs and charts, it’s important to consider basic design principles while also considering whether each chart, graph, or display works cohesively to provide essential information without causing conflict or consuming too much time.

By considering the previous tips, testing your visualization choices, and considering your core goals throughout, you’ll create a managerial report that gets real results.

13) Make your report scannable & drillable

It’s clear that going digital with your management reporting system is essential in our tech-driven age. And as we touched on earlier, two of the significant advantages of these systems are interactive functionality and customizable features.

By being able to customize your reports with ease while taking advantage of interactive features, you can build on your data visualization selection and design practices to ensure your management report template is both scannable & drillable.

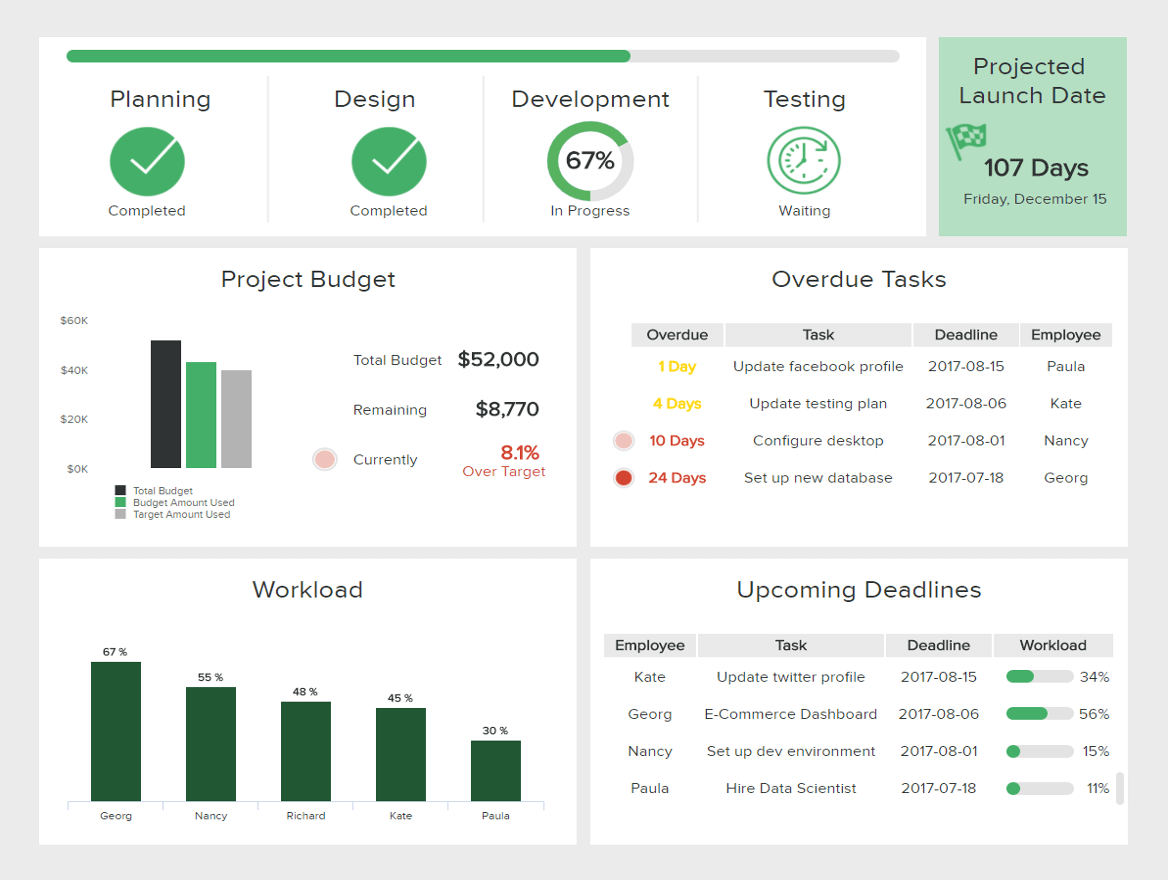

Take this dynamic project reporting example, for instance:

**click to enlarge**

By making customizations and using interactive functions to drill down deeper into particular pockets of information, this IT report sample is effective for quick access to real-time project performance information as well as comprehensive trend-based data.

Working from the top left to the top right and down the project dashboard in a logical format, you can see the dashboard is entirely scannable and customized for cherry-picking important metrics. Here, it’s possible to get a clear gauge of project progress, looming deadlines, budgets, and workloads by simply scanning the page.

Plus, by taking advantage of interactive features and drill-down boxes, it’s possible to dig deeper into your data as required. By embracing customizable and interactive dashboard features, you can build your creations flexibly, working in real-time or with monthly management report tools. If you want to track your progress in a different format, you can take a look at our KPI scorecard article and organize your milestones differently.

14) Deliver real-time data that aligns with your objectives

Regarding major types of management reports, it’s important to understand when to lean on real-time insights. Knowing when to use this kind of dynamic data is the most prominent feature of your dashboard.

We’ve covered the importance of storytelling and selecting a balanced mix of KPIs (for past, predictive, and real-time insights). But what is important to consider with any management report sample is making sure your real-time insights fully align with your objectives.

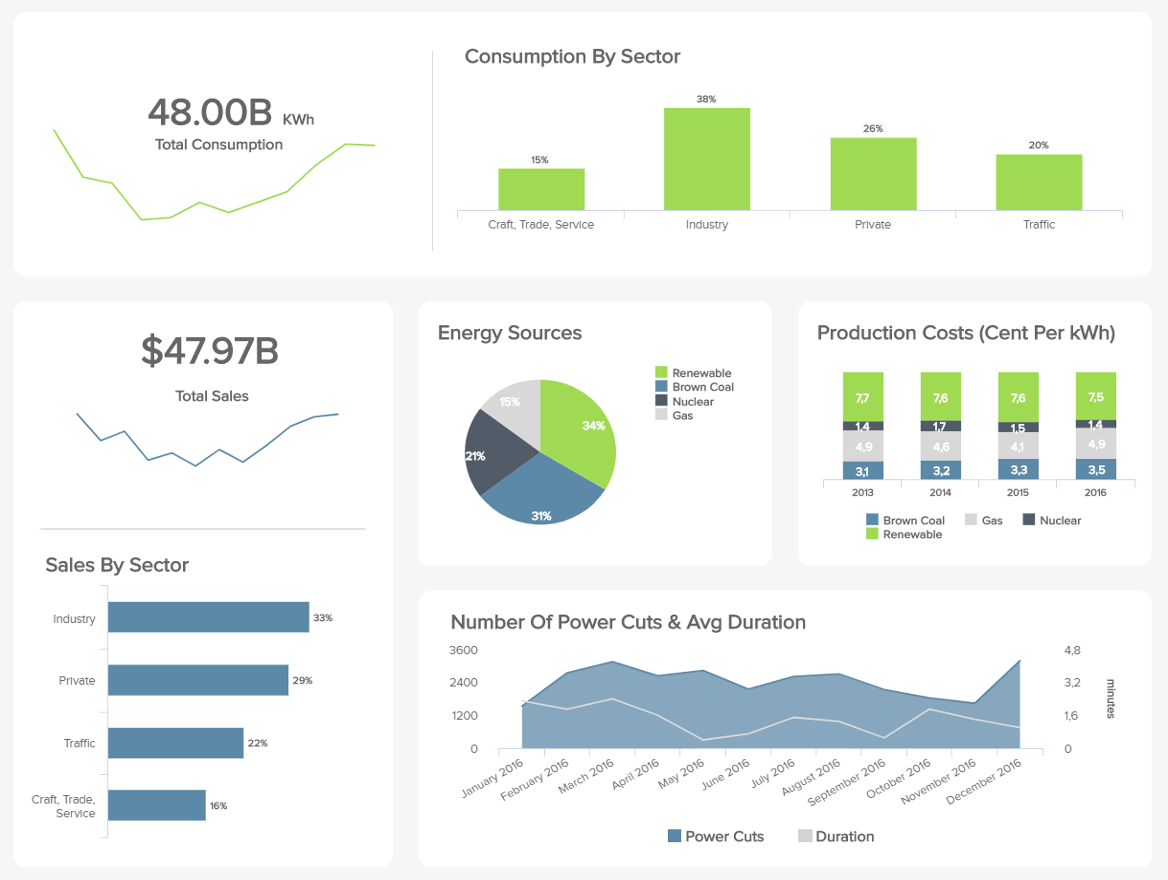

The next of our examples comes in the form of our energy dashboard - a prime representation of well-placed real-time insights:

**click to enlarge**

Energy management is challenging as it requires quick responses to potential issues or inefficiencies to prevent major losses or problem escalations by utilizing modern energy analytics solutions. As demonstrated in this most insightful example, while you can see a mix of data types, the real-time metrics reflect the core aims of monitoring energy consumption and improving powercut management.

When creating your report, here’s what you should do to ensure your real-time data aligns with your primary goals:

- Revisit your key objectives and KPI selections, studying them in greater detail to see whether your real-time metrics “tell a story or paint a picture” that your audience will benefit from.

- Run your report for a week, personally testing it to check if your real-time insights allow you to achieve your goals and make quick, informed decisions.

- Ask other key stakeholders within the organization to test your report and offer their feedback. Based on their (and your) discoveries, make tweaks, changes, or customizations accordingly.

15) Try Predictive Analytics & AI Technologies

Following the line of real-time data, our next best practice is related to advanced management reporting systems. To extract the maximum potential out of your reports, you need to be sure you invest in a tool that will make your process easier, more automated, and more time-efficient. To assist you with this purpose, there are several business analytics tools in the market that can offer you these types of solutions. Let’s look at what you can achieve with these technologies.

Predictive analytics: Unlike not many other solutions out there, datapine provides a predictive analytics tool that takes historical data in order to predict future outcomes in your business performance. Getting these kinds of predictions is valuable as it will let you prepare in advance for the future and spot any potential issues before they happen.

Artificial intelligence (AI): As we’ve mentioned a few times throughout this post, management reports should turn your life easier. For this reason, embracing the powers of AI can take your managerial data to the next level. datapine’s intelligent alerts use neural networks to learn from trends and patterns in your data so they can later notify you if something unusual happens. All you need to do is set predefined targets or goals, and the alerts will set off as soon as a goal is met or something is not going as planned.

16) Keep your dashboards actionable and improve constantly

Expanding on the previous point: whether a financial management report, a monthly management report sample, or any other type of senior dashboard, continual improvements will ensure your offerings remain relevant and actionable.

The digital world is constantly evolving, and as such, business goals, aims, strategies, and initiatives are always changing to adapt to the landscape around them. To ensure your reports work for you on a sustainable basis, you should periodically test each report to check for any irrelevant KPIs while looking for any reporting inefficiencies. This can be done simply by utilizing visual analytics tools that use the power of visualization to ensure your reporting stays on course and improves your business's bottom line.

At this point, you’ll have already laid out the framework for your reports, and by committing ample time to make updates as well as improvements, you’ll remain one step ahead of the competition at all times. Get testing!

17) Develop your reports collaboratively

Managerial reporting systems are designed to offer insight, clarity, and direction.

To squeeze every last drop of value from your managerial reports, you must commit to developing your reports according to the landscape around you—and the best way to do so is as a team.

By taking a collaborative approach to your company's reporting initiatives, you will increase your chances of making tweaks or enhancements that offer a real benefit to your business.

Suppose you're in charge of financial management reporting, for instance. In that case, you should create a tight-knit workgroup of relevant specialists within your organization to gather on a regular basis and assess the relevance of your KPIs or metrics.

With this mix of professional perspectives, you will gain the power to spot any existing report management system weaknesses (outdated visualizations, inefficient reporting layouts, unnecessary data, etc.) to ensure that your accounting management reports not only capture every valuable fiscal insight but work in a way that gives every user the tools to perform to the best of their abilities.

As modern management reporting templates offer flexible 24/7 access across a multitude of devices, it’s possible to develop or evolve your visualizations and insights collaboratively on a remote basis, if required.

We offer a 14-day free trial. Benefit from great management reports!

18) Create a sense of cohesion & consistency

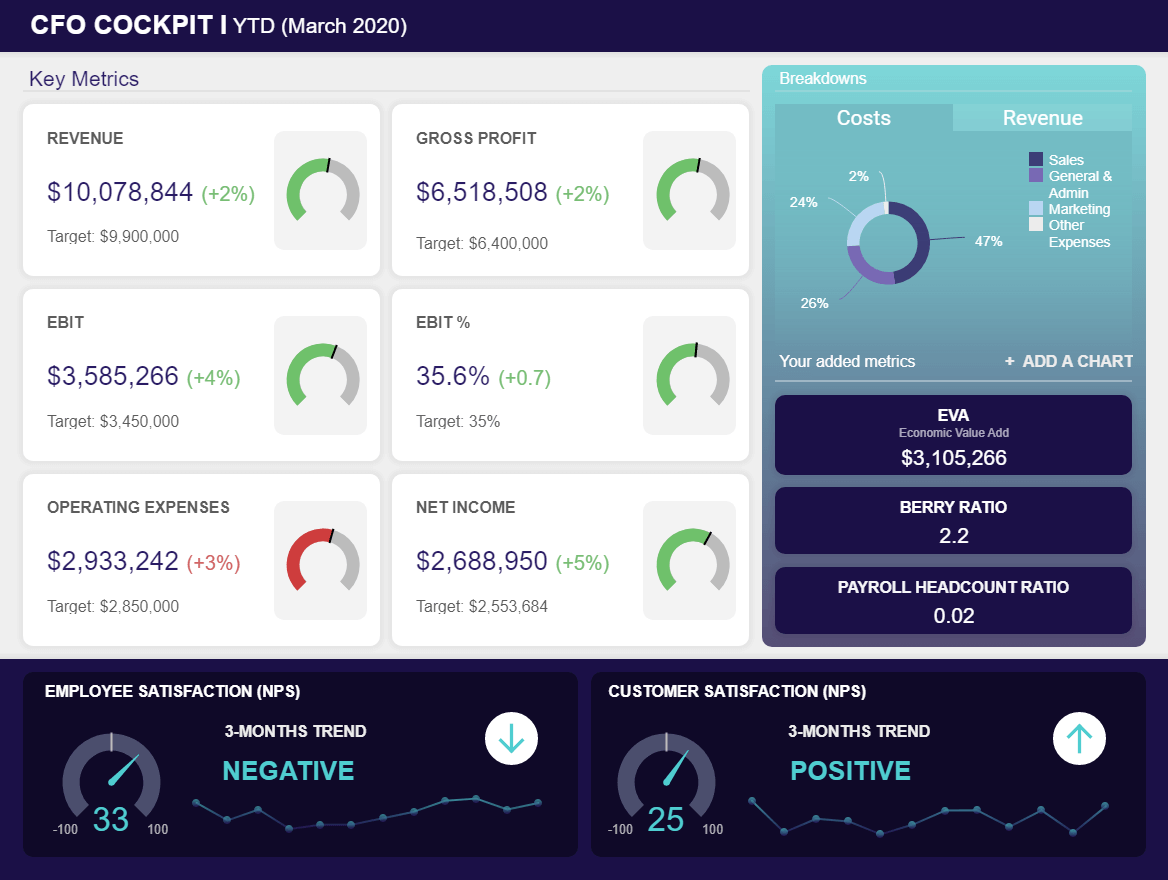

Concerning financial management reporting best practices, our dynamic financial dashboard is as good as it gets. With a balanced mix of scannable visualizations and KPIs designed to drill down into the four primary areas of CFO management, this particular tool demonstrates the unrivaled value of internal executive reports.

**click to enlarge**

Here, everything is geared towards striking a balance between economic value, improved financial performance, and ongoing employee satisfaction, presented in a logical and digestible format for swift decision-making even under pressure.

One of the main reasons this CFO manager report template works so well is it is functional as well as visual cohesion and consistency. Every key element is neatly segmented on screen, with charts that offer a wealth of relevant information at a glance.

As you can see, everything flows, each element fits into the right place, the colors and tones are cohesive, and it’s clear where you need to look when you need very specific nuggets of information at the moment.

Using this template as a working example, which you can adjust also as a CEO dashboard, you can create various types of reports in management with visual and practical consistency and cohesion at the forefront of your mind. If something appears out of place or creates friction, return to the drawing board and start again until everything is harmonious and offers genuine value.

19) Compartmentalize your data effectively

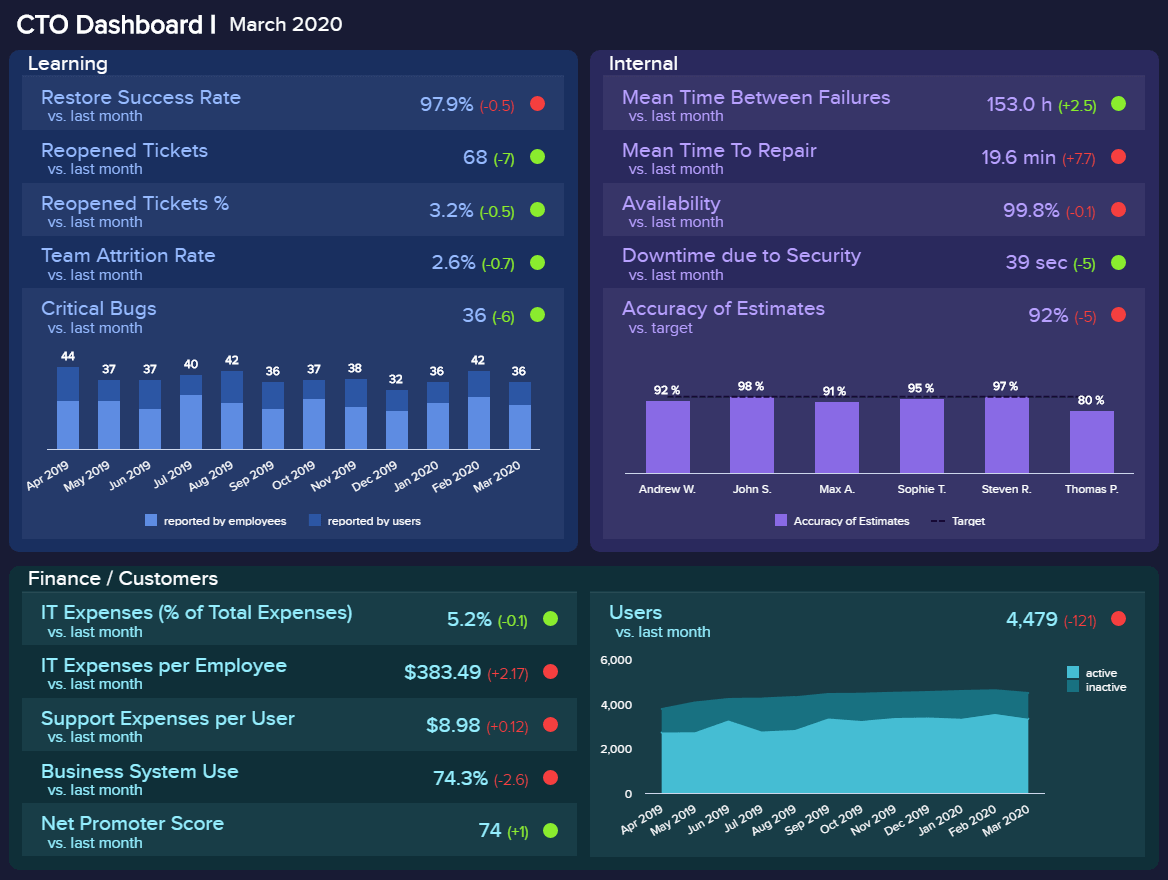

Our striking IT dashboard is a dynamic informational toolkit for anyone leading a company’s technical innovation and progress.

**click to enlarge**

Whether you’re a small, medium, or large business (and regardless of your sector), our CTO-centric management reports template focuses on minimizing technical issues, streamlining tech-based processes, improving team attrition rates, managing new developments, and more.

In addition to its streamlined functionality and sheer reporting power, one of the key reasons this managerial report example is so powerful is its effective compartmentalization. Expanding on our last trip, by focusing on cohesion before considering how you will compartmentalize your insights, you will consistently get the most from your reporting efforts.

We touched on this before, but it’s a vital component of reporting, so it’s worth covering in further detail: once you’ve committed to your data and visual KPIs, examine how each key element fits into your report and place it into the ‘right compartment’ on-page.

Looking at the CTO dashboard, each core branch of information is split into a box under a clear-cut subheading. Within each of these compartmentalizations, there are clearly labeled data, insights, and visualizations.

By drilling down further into how you compartmentalize your reports, you will give yourself the ability to analyze one area of information or grab an entire snapshot at a simple glance. As a result, you will improve your business performance and streamline your decision-making process.

20) Create a scannable timeline

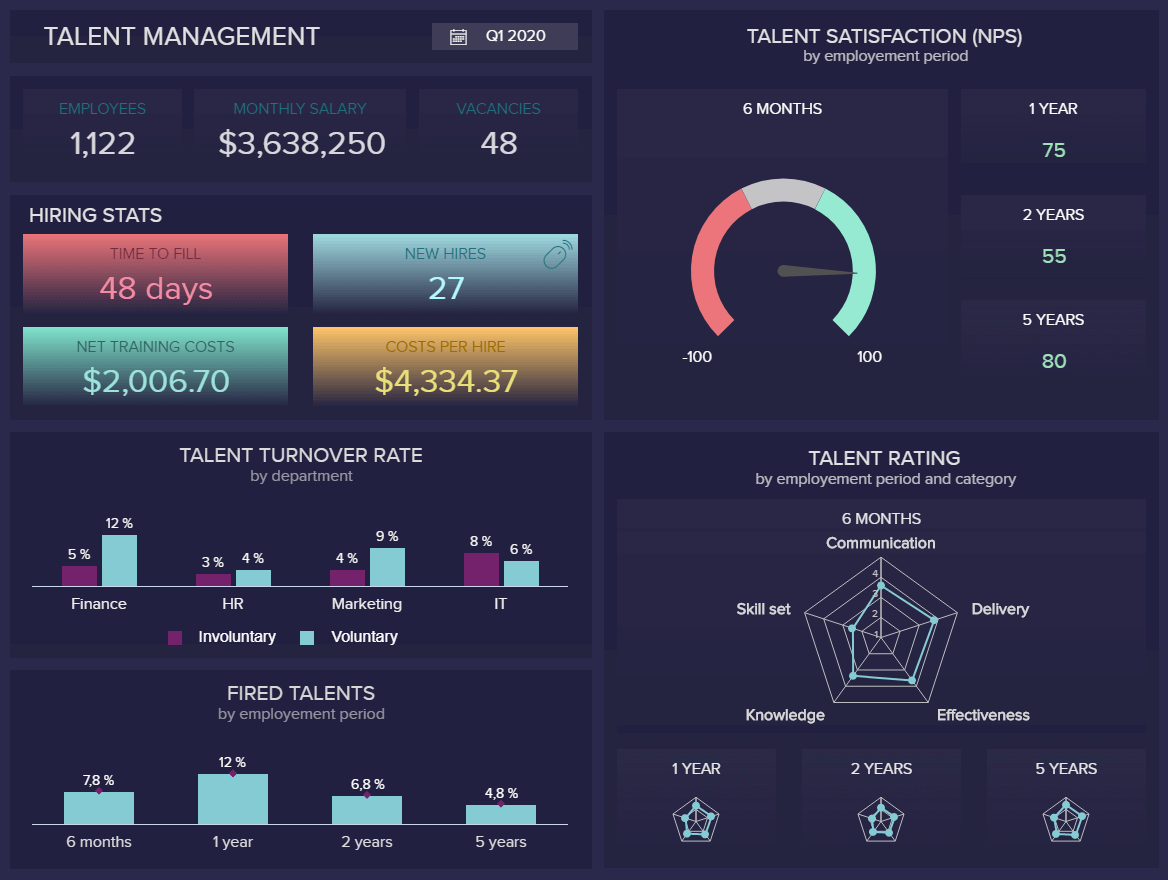

Employee management reporting helps managers make vital improvements to specific functions of the business with clear-cut direction and complete confidence.

Our HR dashboard — a must for any modern HR department — exists to assist personnel-based managers in keeping their employees happy, engaged, and motivated. Employees who feel valued and engaged in the business are generally more productive and more creative, so looking after your talent the right way should be one of your company’s top priorities — no exceptions.

**click to enlarge**

When it comes to HR, managers need to take care of many tasks, which include picking the best payroll system, conducting performance reviews to ensure productivity, hiring the right talents, and more. Putting the talent area into perspective, our HR management reporting template serves up a perfect storm of data-driven insights that covers staff turnover, dismissal, rising talent, and overall satisfaction levels. For example, the talent satisfaction KPI for HR managers gives you a clear overview of whether your business gives enough incentives to satisfy your current workforce.

But not only here, but you will also gain a deep working insight into where you might be going wrong while capitalizing on your strengths and, ultimately, offering the right reward, recognition, training, and support where needed.

What makes this workforce management reporting example so successful is the fact that it provides a solid timeline of information. By working down or across, you can access an excellent balance of historical, real-time, and predictive knowledge with ease.

As such, this report paints a data-centric timeline that will empower any HR manager to examine trends, understand fluctuations in employee engagement rates, and create viable strategies that increase retention while boosting productivity.

The takeaway here? When considering the contents of a good managerial report, it’s always important to look at how your visualizations and design layout create a timeline that allows you to formulate initiatives that will benefit the business both in the moment and in the future.

21) Embed your reports

As we are about to reach the end of this insightful list of tips and best practices, we couldn’t leave out one of the technologies that have revolutionized the reporting landscape: embedding analytics. Essentially, embedding a report means integrating all the functionalities of a business intelligence reporting software, such as dashboards, charts, and more, into your company’s existing system.

Having access to this type of technology is not only way cheaper as your company doesn’t need to invest in creating a system of its own, but it can also provide a great competitive advantage. Embedded dashboards and reports are fully customized to the colors, logo, and font of the organization, allowing employees and managers to enjoy all the functionalities of a reporting system in a familiar environment which can boost productivity and performance.

22) Don’t neglect security and privacy

So far, we’ve covered tips related to the planning, design, and usability of your reports. Now, we will talk about a topic that is often overlooked but is becoming increasingly important, privacy and security. According to research, in 2021, 70% of small businesses reported a cyberattack of some kind. The financial impact of these attacks can significantly damage an organization. It is believed the average cost of an email comprise attack is $130.000. At the same time, ransomware attacks are projected to reach $11.5 million in damages this year.

That said, privacy and security issues affect businesses on a financial level but also on a reputational and legal one. Not protecting sensitive customer and employee data, such as addresses, bank records, phone numbers, and others, can expose them to serious damage that can lead to legal repercussions.

To prevent critical business information from falling into the wrong hands, you should implement strict access controls, data encryption, and data anonymization processes, among other things. Plus, you should train your employees about potential threats and prevent risky behaviors, such as accessing reports on a public network. Tools such as datapine provide a secure environment for your management reporting process. This includes secure sharing options such as password-protected URLs or strict viewing rights to make sure only authorized people have access to the reports.

23) Explore self-service analytics tools

The times when financial or management reports were only meant for analysts or scientists are long gone. In today’s data-driven era, if a business wants to succeed and get an advantage over competitors fully, they need to make sure that everyone in its organization can benefit from data analysis. For this purpose, implementing a self-service business intelligence tool can be the answer.

In simple words, self-service BI refers to the process or tools companies use to analyze and visualize their data without needing any prior technical skills. Management reporting systems such as datapine include a user-friendly interface as well as an intuitive dashboard designer that will allow you and anyone in your business to visualize insights from several sources and create powerful reports with just a few clicks. Businesses that benefit from these types of solutions can extract valuable information into their performance and constantly spot improvement opportunities.

24) Assess data literacy

As mentioned a couple of times already, in order for your management reporting process to be efficient, it is necessary to involve the entire organization. While self-service tools such as the ones we mentioned in the previous point are extremely valuable to achieve this task, there is still a level of knowledge or analytical awareness that needs to be had across all employees for the process to be successful. To do so, assessing the level of data literacy is a great place to start.

Data literacy refers to the ability to understand and communicate using data. To evaluate the level of literacy of your employees, you can carry out surveys to categorize them depending on their level of knowledge. With the results, you can set up training instances to get everyone in the same place with the tools and concepts that will need to be used across the organization’s analytical journey. In time, everyone will be able to generate stunning management reports and use them to collaborate with each other. This leads us to our next and final best practice.

25) Encourage a data-driven culture

Following on from the prior point, by implementing self-service solutions, you will gain an invaluable benefit: a data-driven culture for your business. Your company culture is the blueprint for how your business runs, as well as how everyone within your business interacts or operates internally. Naturally, your internal culture will have a notable impact on the way your clients, customers, and affiliates view your business.

Seventy-eight percent of top business leaders believe that company culture is among the top five things that add value to their company. That said, if you want to maximize the power and wider organizational values of your data-driven reporting efforts, you should make it a key component of your company culture.

If you place the value of data and using it to its maximum capabilities at the heart of your company culture, you will empower everyone to embrace and make use of the reporting tools that will improve their performance while making their roles easier (which, in turn, will boost employee satisfaction levels).

To do so, you should hold regular meetings to explain how data reporting can benefit every department within your organization while holding educational workshops where everyone within the business can learn how to use the tools.

Let’s now go over the history of these reports, where they come from, and how they have been developed.

History And Trends Of Management Reporting

In the past, legacy systems were used to prepare reports for management – and still are, in many cases. These systems are much more useful than financial reports but still have their drawbacks. Legacy systems are often quite technical in their operation and interface, which makes them challenging for most non-IT personnel to use effectively. This creates a situation of “lag time” between a member of management wanting a report and actually receiving it.

In modern times, with the breadth and depth of data available growing at an astonishing rate, these challenges have only escalated. As Peter Wollmert, an EY global leader, stated in a quote from a Financial Director article: “Many [CFOs] are encumbered by legacy systems that do not allow reporting teams to extract forward-looking insight from large, fast-changing data sets.”

To put the rise of management reporting into perspective, let’s analyze the results of Deloitte’s survey about the changes in this managerial practice. As we mentioned before, top managers are no longer satisfied with static financial reports that don’t provide the level of insights the business needs to grow. Although getting a clear picture of a company’s finances is fundamental, modern management reports provide the context and reasons behind the business's financial results, which makes it possible to go deeper into the roots for better decision-making.

Although managers have the willingness to adopt these reporting practices, the survey shows that only 24% of the reporting time is actually spent doing analysis and building strategies. The reason is businesses today are still spending an insane amount of time building their reports. Paired with this, 50% of respondents said they were unsatisfied with the speed of delivery and the quality of the reports they received.

What businesses need today are management systems that will provide them with the perfect mix of internal and external real-time data to put their business performance into context and drive those much-wanted business insights.

Tools such as datapine provide businesses with an all-in-one management reporting system in which they can connect all their data sources to create real-time automated reports in the form of professional business dashboards. By adopting this type of technology, managers and their teams can save countless hours on manually gathering the data and creating the reports, and spend all the necessary time monitoring and analyzing their performance in the most interactive and efficient way.

We offer a 14-day free trial. Benefit from great management reports!

Why Is It Important To Write A Management Report?

For any function and in any industry, reports are more than useful, they are crucial to the well-functioning of the company.

Reporting is all the more important in management as it has higher stakes and holds bigger, cross-disciplinary decisions. In general, reports are important to management for various reasons: they measure strategic metrics to assess and monitor the performance, they set benchmarks about said performance, enable the business to learn from its activity by leaving a track record, and finally, enhance communication. Here’s a short list of benefits:

- Measuring strategic metrics to assess and monitor the performance: by now, we’ve understood that if businesses wanted to grow, they would need to implement a way to measure their performance against their competitors – but also against their own

- Helping you understand your position: a management-style report provides you with the right metrics to get a snapshot of your business's health and evolution. You can compare it to your competitors to focus on or realign your strategy.

- Setting clear-cut performance benchmarks: thanks to that track record, you have a regular benchmark about how you perform both operationally and financially.

- Learning and reproducing – or not: benchmarks are a guide to tell you what works and what doesn’t. From it, you can learn the best and worst practices to develop or avoid.

- Enhancing communication: among partners, investors, customers, and colleagues. Management-type reports develop the visibility of the different activities across departments and improve communication within the company.

- Improving collaboration: as a direct result of improved internal communication, senior-level reports enhance interdepartmental collaboration. With people working cohesively towards a common goal, departments can use management reporting discoveries to collaborate on specific projects or initiatives, catalyzing success in a number of key areas.

- Boosting engagement & motivation: a well-crafted manager-level report makes critical company data accessible to all, which improves individual performance. When people perform at an optimum level and are recognized for their work, they will become more engaged, inspired, and motivated. This, in turn, will increase productivity across the organization.

- Fostering continual business growth: solid reporting in management indeed improves productivity and decision-making, which fosters consistency as well as continual business growth. If you’re growing consistently over time, you will ensure long-term success - the most powerful benefit of reporting in management.

Essential Types Of Management Reports

As we’ve mentioned throughout this post, there is an immense amount of growth possibilities when implementing a modern management reporting system in your business. To finalize interiorizing you into the benefits of these powerful tools, we will mention 9 essential types of reports for management you can adopt for different analytical purposes.

- External reports: We’ve already introduced you to this type of report at the beginning of the post. As its name suggests, these reports are aimed at external stakeholders, which can be investors, creditors, suppliers, and bankers, among others. These reports can also be used to provide context into something that might be affecting business performance, for example, industry trends.

- Internal reports: The next in our list are internal ones. This refers to any managerial task that must be reported on, and it is not expected to follow legal format standards. Internal reports can be used for top-level, middle-level, or lower-level management, and their frequency will vary depending on their main goal.

- Progress or status reports: Tracks the progress of a project or a goal in detail. By using this type of management report, you can track all activities related to the completion of the project, see how far you are from the final goal, and if tasks are running at the expected schedule.

- Operational reports: This type aims to track all aspects related to the operation or performance of different metrics. They are usually created on a daily, weekly, or even monthly basis and are used to optimize business processes, lower costs, spot trends, and improve the overall day-to-day running of the company.

- Analytical reports: This type of business report uses quantitative and qualitative data to analyze, evaluate, and filter the performance of a company's strategies. They can deliver predictions and trends for better decision-making and business innovation.

- Industry reports: As its name suggests, this type gives managers an overview of the industry's status. These reports are helpful because they enable decision-makers to understand their position in the industry and their competitors. The insights provided in this report can help businesses extract benchmarks to measure their performance.

- Product reports: C-level executives need to oversee every single aspect of the business, and one of them is product development. These reports provide a complete overview of product development, such as feature adoption, top-selling products, and willingness to pay, among other things. Through them, decision-makers can find improvement opportunities and boost their products and services through the power of analytics.

- Project reports: In a business context, there is always a range of projects being carried out. These reports provide an overview of the development of a project with insights into completed and upcoming tasks, budget usage, competition percentage, and launch dates, among other things. Through them, teams can stay connected to ensure every task is carried out efficiently and in the expected time.

- Compliance reports: As mentioned previously, companies have been generating financial reports for decades. These reports enable them to stay compliant with law and tax regulations and provide an accurate picture of financial health to investors and other external stakeholders.

What Should A Successful Management Reporting System Include?

In our 25 tips to generate efficient management reports, we presented you with a few features any software worth its salt should include, such as real-time data, embedding capabilities, predictive analytics technologies, and more. A management reporting system that wants to be successful in today’s fast-paced world needs to support itself with a set of functionalities and technologies that will make it more efficient in various aspects. Paired with the features we already presented before, a couple of others that are fundamental include:

- The ability to connect multiple data sources

If you’ve ever dealt with generating a report, then you must be aware of the fact that manual work is the enemy of productivity. For this reason, your management reporting system should provide you with the possibility to automatically connect multiple external and internal data sources with just a few clicks. Management reporting tools, such as datapine, offer professional data connectors that allow users to merge all their sources into one location. The best part is that the information in them is updated automatically, eliminating any kind of manual work from the process.

- Be user-friendly and intuitive

Another important functionality is user-friendliness and accessibility. Analytics has become a mandatory practice for modern businesses, meaning generating reports and analyzing the information in them is a task that cannot be segregated to people with technical knowledge anymore. When investing in professional software, ensure it has a user-friendly interface that anyone in your organization can use. This way, you’ll make sure all employees are empowered to integrate data into their daily routines.

- Interactive filters to explore your reports

While report generation is an important part to consider, data exploration is equally as important. Traditional reports created on PowerPoint or Excel often limit users to only analyze the information that is visually available. Modern management reports should be interactive and provide a set of filters that allow users to navigate the data and extract deeper conclusions from it. For instance, datapine’s drill down filter allows you to explore lower levels of data just by clicking on a specific chart. For example, say you have a chart showing sales by product category. A drill down would allow you to click on a specific category and see the best-selling products in that category. This proves to be a great method to support discussions and make more improved strategic decisions.

- Automation of various tasks

Going back to the first point, automation is key when it comes to achieving an efficient management reporting process. We already talked about merging your sources of information as a key automation feature. However, this is only the tip of the iceberg. Any reporting system worth its salt should also provide other automation features, such as report automation and sharing. This means telling the tool that you want to generate a report with specific data in it, and you want it sent to a specific recipient on a specific date and time, and the system should do it on its own. Relying on automation for various tasks that would otherwise take a lot of time and resources is a great way to focus your efforts on growing the business and carrying out successful strategies.

How To Prepare A Management Report – Summary

To sum up, the main steps we have explored throughout this guide and cement our understanding of the question “What is management reporting,” here is a list of the 25 best practices you should use to prepare a solid report or overview. By taking the time to get acquainted with these approaches, you will boost your business intelligence (BI) initiatives sooner than you think.

Without further ado, let’s summarize:

- Set the strategic goals and objectives: Start by defining what you want to achieve, why you need to write that report, and who you are writing it for.

- Clean your data: Make sure it is clean from any formatting errors or duplications to avoid damaging your analysis later.

- Choose the right KPIs for your audience: Different positions have different needs – keep in mind who will read what you write to know what you need to focus on.

- Set measurable targets: Set performance benchmarks or targets to evaluate the success of your strategies toward achieving general company goals.

- Take customer feedback into consideration: Customers are the backbone of any business, and you need to understand what your business is doing wrong as well as right.

- Polish your storytelling skills: You have hard data in your hands that need to be understood by everyone: clarifying it with a nice story backed with a comprehensive dashboard will convey your insights even more easily.

- Pick the right visuals: Understand the goal of your reports to help you pick the right graph or chart to visualize your data.

- Make your report visually pleasing through focus: With the help of BI software, you can build compelling dashboards in no time that will be your best ally when communicating your findings.

- Clarity is the watchword: Follow some presentation and design principles to stay on the safe side while elaborating your report.

- Don't mislead: make sure you follow design best practices and avoid unethical manipulations of the data to avoid misleading your audience.

- Go digital: Paper-based reports are of the past. Put your hands on an online dashboard tool that will let you consolidate your data in one central place and quickly and smoothly build interactive reports with always up-to-date information.

- Striking the balance: To ensure you get the most from your centralized digital dashboards, you need to make sure that the visualizations work well on-page and help those within your organization obtain at-glance information with ease, devoid of confusion.

- Scannability + drillability = success: By taking full advantage of the interactive functionality of digital reporting dashboards, you can improve the scannability of your dashboard reports while using filters and drill-down boxes to dig deeper into important pockets of information with ease.

- Real-time data relevance: Real-time insights are invaluable to any organization—but only if they align with your core reporting goals. Test your reports before rolling them out across the organization, checking your real-time metrics for clarity and relevance.

- Keep on improving: The digital world is constantly evolving. Sector, niche, or industry aside, you must regularly test your reports, making changes or customizations to iron out any data that has become redundant or inefficient. Never stop testing; never stop improving.

- Use predictive analytics & AI: Benefit from advanced analytical technologies to spot trends and patterns in your data and get a pick into your future performance.

- Develop your reports collaboratively: When improving and enhancing your reports and dashboards, you should work as a tight-knit team, taking everyone’s ideas and perspectives on board. Doing so will ensure your reports are valuable and built for success at all times.

- Create a sense of cohesion & consistency: From both a visual and functional perspective, focusing on creating a sense of consistency and harmony with your KPIs and visualizations will improve your reporting success across the board.

- Compartmentalize your data effectively: In addition to making sure you create cohesion within your on-page reporting layout, you should also compartmentalize every key branch of information, creating separate boxes and subheadings for quick access to effective information.

- Create a scannable timeline: When creating your dashboard reports, developing an informational timeline over a specific period will make it easier for you to put together strategies and initiatives in a wealth of key areas.

- Use embedding analytics: Use this technology to make your reports more professional and accessible to all stakeholders.

- Don’t neglect privacy and security: Implement security measures to ensure your financial, customer, and employee data doesn’t fall into the wrong hands.

- Use self-service analytics: Involve all your employees in your reporting process with the help of intuitive self-service BI tools.

- Assess data literacy: Evaluate your employee's analytical knowledge and provide training instances where needed.

- Encourage a data-driven culture: Your company culture is, in many ways, the beating heart of your entire business. By taking measures to place respect and value for data-driven reporting at the heart of your business, you will empower everyone to embrace the concept, boosting the value of your dashboard-centric efforts.

With all of these reporting best practices, you can now perform online reporting that will help your company’s leaders to make effective, data-driven decisions.

We offer a 14-day free trial. Benefit from great management reports!

Key Takeaways Management Reporting

On our journey, we’ve outlined the management reporting definition, looked at management reports examples, explored best practices, and drilled down into the business-boosting benefits of dynamic digital dashboards.

It’s clear that by embracing the wealth of digital data available to your business and harnessing it effectively, you stand to make the kind of management decisions that will drive your organization forward with force, accelerating your success in the process.

In a nutshell, you should follow the management reporting examples by hand-picking a few relevant KPIs to display and tell a clear story with your data. It’s also essential to work collaboratively, creating a healthy ecosystem of data-driven innovation that will empower everyone in the business to benefit from the unrivaled power of managerial-style reporting. Knowledge is indeed power, and if your business runs on it, you will reap great rewards, both now and in the long run.

Combine this concept with the help of our BI dashboard software which will empower you to work on the evolution of your data in real-time while enabling you to create efficient dashboards, and you will drive your business well above the competition.

Take charge of professional destiny today by trying datapine with a 14-day trial, completely free, and start creating your own reports just with a few clicks!