WHAT IS FINANCIAL ANALYTICS?

Financial analytics is the process of collecting, visualizing, monitoring, analyzing, and predicting data in the financial sector with the goal to evaluate the financial performance of a department or company in order to make better financial decisions. Finance is all about numbers, and the power of understanding these numbers determines the success of an organization. Getting the precise and meaningful information from these financial facts and figures is challenging. Finance analytics tools, with its numerous features, provides you the precise and unobserved meaningful information, removing any complexities out of it. It helps in monitoring your cash flows including revenue and expenses throughout the organization. With integrated data from CRM, ERP and other systems, it offers a unified view of all the data concerning the whole organization. This helps in avoiding risks and grabbing new opportunities. Other than that, our modern financial analytics software for finance features the creation of an individual report (as per department and stakeholders) and financial dashboard that is easy to understand.

"We were amazed how easy it was to use datapine and get the first KPIs within a couple of minutes. An average Excel user can configure and work with datapine with zero IT overhead."

Sebastian Diemer | Founder Kreditech

FINANCE KPIS AT YOUR FINGERTIPS

The integrated overview of finance data from different systems, in combination with a system-wide analysis of data and financial KPIs, will provide you a real-time information and aid in accurate forecasting.

- Seamlessly track revenue, expense and profitability

- Integrated solution for planning, budgeting, and report creation

- Accurate forecasting and budget planning

- Improve efficiency of business process

- Create tailored reports for stakeholders

Become a data wizard within less than 1 hour!

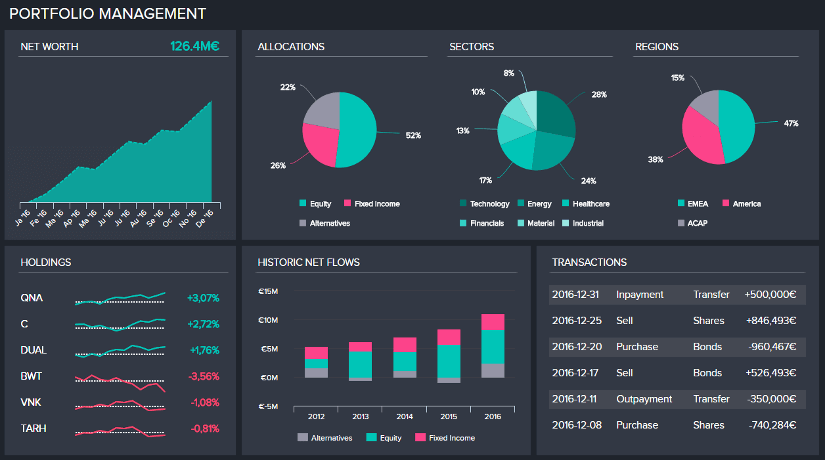

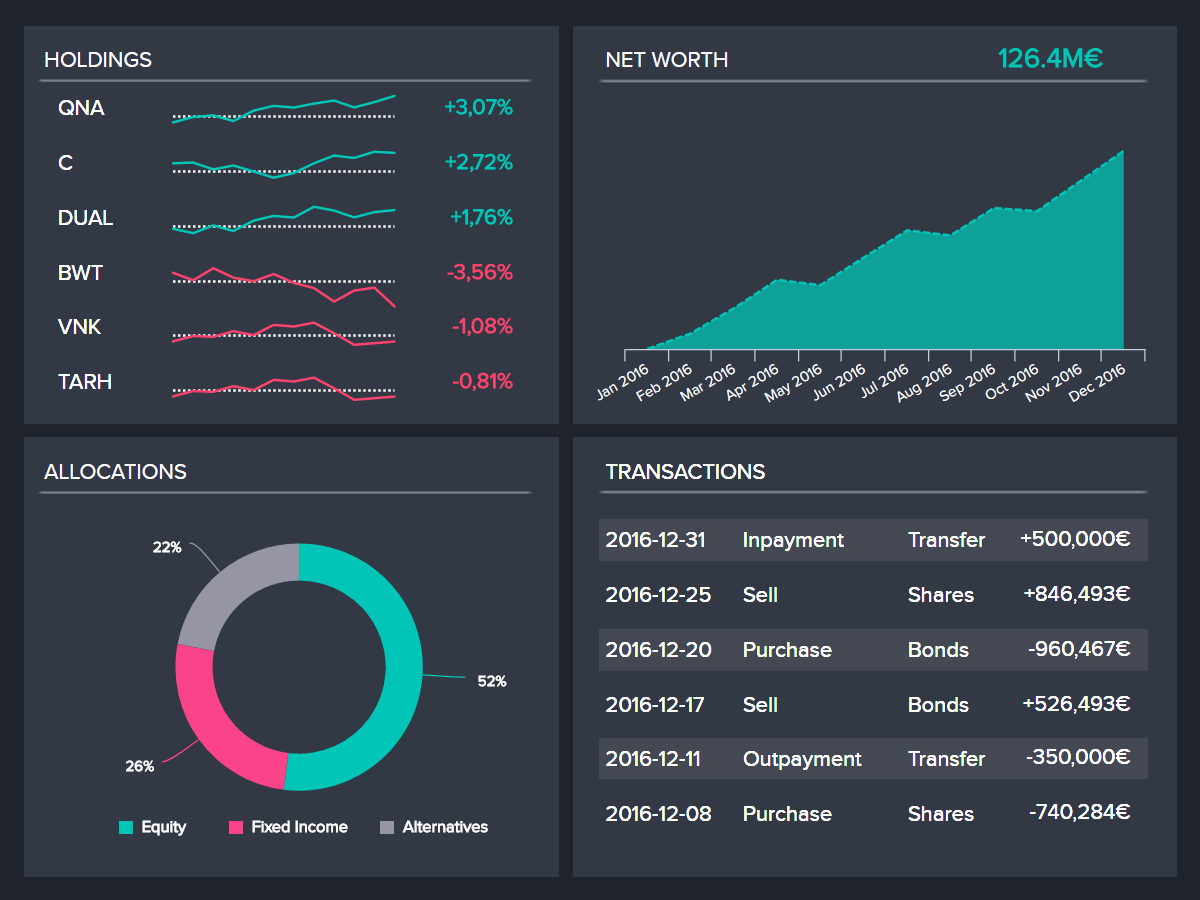

FINANCE ANALYTICS & PORTFOLIO MANAGEMENT

As an organization with a lot of stakeholders, clients or investors, you may struggle to have a comprehensive perspective for your portfolio and thus need to implement efficient management processes to keep track on it. Thanks to modern finance analytics software and the collection of data from all systems, our solution offers you better and more accurate forecasts, while the discovery of trends from past data helps you in strategic planning and decision making. You also get reliable information and insights through the real-time information processing that you can share via custom-made reports for each stakeholder. The visualization of easy-to-understand metrics is essential to avoid risk, while strategic budget and resource planning are delivering insightful information that enables you to seize opportunities efficiently. Today, organizations reach higher levels of portfolio management than ever before. In order to bring them to maturity, our advanced finance analytics tools will allow you to optimize cash flows, control expenses, and increase revenues, which leads to an enhanced enterprise planning and resource allocation.

Let us show you the importance of modern financial reporting and analysis.

Read Blog Article

Mute the noise of your finance data to focus on insightful and impactful KPIs.

View KPIs

Get an evaluation! Want to talk to us about how datapine can help your business?

Get in touchWHAT IS FINANCIAL ANALYTICS SOFTWARE?

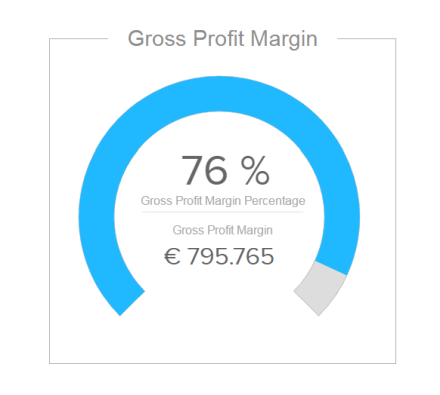

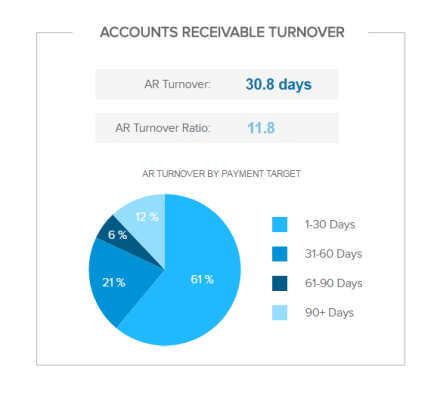

Financial analytics software is a management tool used by companies and financial departments to ensure the proper tracking of financial KPIs such as net profit margin, return or assets, and many others to enable healthy financial development and results. Your company’s financial data will be subject to many checks and tests, analyses and evaluation. Your finance analytics are the life force of your company as it reflects how your activities are going, your organization’s health and stability, and various other important aspects needed for stakeholders and investors. In an always-more competitive environment, companies need more than just financial reports and basic statements. They need forward-looking insights that can help the definition of future business strategies, and improve the decision-making process thanks to data-driven material.

Because our economy is changing so rapidly, decisions have to be made as quickly – hence the need for real-time financial data, that will allow for an easier assessment of current operations, and a better planning to allocate resources where the needs are appearing. Many organizations still struggle to generate actionable insights from raw data that will enable them to make smart decisions, and undergo rapid change after identifying weaknesses in some business operations that will need to be transformed to have an actual added value.

THE IMPACT OF MODERN FINANCIAL ANALYTICS TOOLS

The financial industry is one of the many that will be – or already is! – disrupted by the new generations’ habits and that need to stay on the lookout for innovation. The business impact of using state-of-the-art financial analytics tools is of course decisive. Expanding your capabilities to include predictive and prescriptive analytics will deliver smart insights, from margin analysis to price optimization to product forecasting. By blending financial internal information with external info like demographics, customer profile or social media, a financial analytics software will address crucial business questions with an unrivalled speed, accuracy and ease. In times of constant change, in a volatile financial economy, harnessing modern technologies is crucial to solve the new challenges arising – and history has shown us that those who fail to embrace them have a tough time. Cost efficiency, productivity, growth, improved risk, the impact of finance analytics is transversal and give room for smarter decision, helping to adapt and facilitate innovation.

Finance analytics will be around as long as there are businesses. The importance of financial reporting and analysis does not lay only within organizations that need to collect financial data by law, but also to make better-informed business decisions that will ultimately reduce costs, and enable sustainable financial development. At datapine, we want to help companies harness their financial data, so that they can uncover insights, identify trends, prevent potential future risks, meet their goals and generally make better-informed decisions concerning their strategy. The sheer volumes of data collected by financial companies is traditionally underutilized, this is why our financial analytics software gathers in one central place your various financial data and helps you understand what lies beneath it. Put the pieces together and combine internal and external data, filter and analyze dynamically and report with confidence, thanks to real-time information and powerful data visualizations.

OPTIMIZE YOUR FINANCIAL ANALYTICS STRATEGY

In an industry already loaded by numbers, financial analytics is not only a daily task but also good habit – it is hence not difficult to adopt some best practices. The business environment is rapidly changing financial planning and analysis, and requires always more insights at a faster pace.

To do so, accessing a professional financial analytics software is key. You will consolidate the various data sources in a single point of truth and analyze all your metrics conjointly – that way, you can easily decipher patterns and trends that would otherwise be overlooked. A best practice for that is to coordinate with other departments and functions of your company to gather, analyze and share data results. Unifying the numbers is key to uncover findings that can bring a lot of value to your analyses. Working on real-time data is also an important aspect of the financial sector, as any shift in the numbers can make or break a deal, a project, or a strategy. Delivering real-time analyses to decision-makers will give them all the material they need to build the right strategy backed with accurate information.

Become a data wizard in less than 1 hour!