The Importance Of Financial Reporting And Analysis: Your Essential Guide

Table of Contents

1) What Is Financial Reporting?

2) Why Is Financial Reporting Important?

3) The Benefits Of Financial Reporting

4) Who Uses Financial Reporting And Analysis?

5) 5 Use-Cases For Financial Reporting

6) Different Ways Of Financial Reporting

7) Common Types Of Financial Reporting

While you may already know that a detailed business financial reporting process is important (mainly because it’s a legal requirement in most countries), you may not understand its untapped power and potential. In fact, financial analysis is one of the bedrocks of modern businesses. It offers insight that helps companies remain compliant while streamlining their income or expenditure-centric initiatives.

Utilizing finances data with the help of online data analysis allows you to not only share vital information internally and externally but also leverage metrics or insights to make significant improvements to the area that helps your business flow.

To help you unlock the potential of financial analysis and reporting, we’ve produced this guide to tell you everything you need to know about the topic. Let’s hit it off with a detailed definition.

What Is Financial Reporting And Analysis?

Financial reporting and analysis is the process of collecting and tracking data on a company’s finances on a monthly, quarterly, or yearly basis. Businesses use them to inform their strategic decisions, gain new investors, and comply with tax regulations.

Each of these financial KPIs is incredibly important because they demonstrate a company's overall ‘health’ – at least when it comes to the small matter of money. These types of KPI reports don’t offer much insight into a company’s culture or management structure, but they are vital to success, nonetheless.

As we continue, we’ll explore financial company analysis use cases. But first, it’s worth noting that these reports are crucial for anyone looking to make informed decisions about their business. Financial reporting software and BI reporting tools offer invaluable information on investments, credit extensions, cash flow, and so on. It is also legally required for tax purposes.

That said, various types of financial reporting and analysis can serve different purposes. Some of the most common ones include:

- Income Statement: Also known as profit and loss, an income statement is a financial analysis report that shows the company’s income and expenses over a given period with a focus on four key elements: revenue, expenses, gains, and losses. The main goal of this statement is to understand if the business is making money or not. It does this by summarizing key sales activities, costs of production, and any other operational expenses during an accounting period. The report subtracts the revenue from all expenses to understand how much profit (or loss) the business had.

- Balance Sheet: It provides a detailed overview of a company's assets, liabilities, and stockholders’ equity. Essentially, a balance sheet summarizes the business’s economic health at a given point, usually monthly or quarterly, and can be used for internal or external purposes. On the one hand, it can be reviewed internally by any stakeholder, such as managers or employees, to understand if the company is going in the right direction. On the other hand, anyone interested in investing can use a balance sheet externally, as the report provides useful information about the available resources and how they were financed.

- Cash Flow Statement: In simple words, a cash flow statement shows the amount of cash the company generates and the costs for which the cash is being spent. It contains elements of the income statement and the balance sheet, making it critical to successfully managing a business. A cash flow statement is usually divided into 3 different areas that classify all the cash received and paid. First, we see the operating cash flow, which shows revenue, expenses, gains, and losses, and then we have the investing one, which shows the cash from debt and equity purchases and sales. Lastly, we have the financial one, which reports on long-term liabilities such as loan payments and equity items such as the sales of company stock.

- Statement of shareholder equity: As its name suggests, this report shows the changes in shareholders' equity from the beginning to the end of an observed accounting period, typically a year. It gives investors transparency regarding their equity, how it is fluctuating, and what business activities are responsible for those changes. It does this by calculating the difference between the company’s assets and liabilities, constituting a key part of a balance sheet. However, big corporations might generate it as a separate statement. The statement of shareholders' equity is usually composed of the following elements: preferred and common stock, treasury stock, additional paid-up capital, retained earnings, and unrealized gains and losses, among other things.

- Statement of retained earnings: Connected to the previous report type, the statement of retained earnings shows the accumulated profit of a business after net income has been summed and dividends paid to shareholders. It shows how much earnings a company has made during an observed period and helps owners and decision-makers assess the business's financial situation and evaluate potential reinvestments or growth opportunities based on the retained earnings left for the coming accounting period. It can be generated as a part of a balance sheet, income statement, or separate document.

- ESG reporting: ESG stands for environmental, social, and governance reports. This reporting type has become increasingly popular now that legislators, societal expectations, and investors are turning their attention to the environmental impact of businesses, pressuring them to be transparent about the climate impact of their activities and operations. Because of this growing interest, ESG factors are now considered indicators of a company's long-term success; investors and key stakeholders request that these factors be included in the company's statements. That said, a well-constructed ESG report should include environmental performance metrics such as energy use, greenhouse gas emissions, water usage, and waste generated, social metrics such as labor practices, human rights impact, and diversity efforts, and lastly, governance metrics such as regulatory compliance, board structure, and political contributions, among others. This is especially important now that sustainable technology is considered amongst the biggest growing technology trends of 2024.

Whatever your company’s goals are, with the right analytical approach, you can significantly accelerate the growth of your business. In this post, we will see the power of financial analysis and reporting in detail, look at real-world finance reporting examples, and discuss why this approach should be vital to every modern business strategy.

Now that we’ve explored what we consider a good definition of corporate financial reporting, let’s glance at the importance of these kinds of reports.

Why Is Financial Reporting Important?

A report from McKinsey suggests that leveraging data to create more proficient marketing reports and to make more informed decisions can boost marketing productivity by 15 to 20%, which translates to as much as $200 billion based on the average annual global marketing spend of $1 trillion per year.

If you apply that same logic to the finance sector or department, it’s clear that reporting tools could benefit your business by giving you a more informed snapshot of your activities.

Financial reports offer a wealth of insight that can streamline your business’s fiscal activities. To illustrate the importance of this process further, let’s break these ten primary reasons for corporate financial reporting down into more detail.

1) For taxes

You may have heard the phrase: the only two certainties in this world are death and taxes (or something similar).

That said, taxes are arguably the biggest reason for the importance of financial statement analysis – basically, you have to do it! The government utilizes such reports to ensure you pay your fair share of taxes. If financial reports weren’t legally required, most companies would probably use management dashboards instead (at least for internal decision-making purposes).

The government’s requirements for these documents have created an entire industry of auditing firms (like the “Big 4” of KPMG, Ernst & Young, Deloitte, and PWC, among others) that exist to review companies’ financial reports independently. This auditing process is also a legal requirement.

2) For other companies, investors, shareholders, etc.

If you’re considering investing in a company, it only makes sense that you’ll want to know how well it is doing.

This is where the importance of financial statements comes into play for investors, credit vendors, and banks considering lending money to a company. In these situations, you will need to understand how likely you are to be paid back so that you can charge interest accordingly.

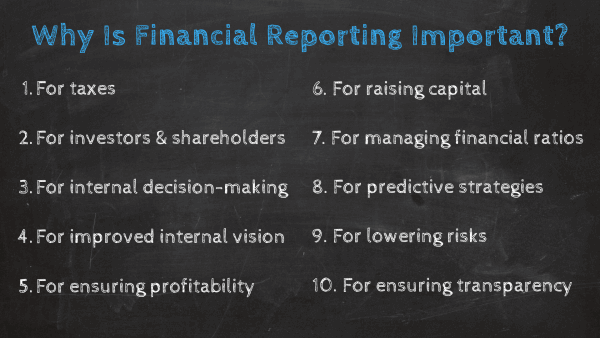

For this purpose, it’s great to have an investor relations dashboard at hand. With metrics such as the return on assets, return on equity, debt-equity ratio, and more, the investor’s dashboard displayed below offers a detailed overview of the company’s performance tracked over a period of time. The value of this tool lies in its interactivity. If you want to take a deeper look at some of these indicators, you just need to click on them, and the entire report will be filtered based on that.

**click to enlarge**

The importance of financial analysis and statements also applies to stakeholders. If you own equity in a firm or are an activist investor who owns a major equity position, then having full disclosure of all assets, liabilities, use of cash, revenues, and associated costs is essential. You will also want to understand if the business is doing something it shouldn’t (such as in the case of Enron).

Due to a series of laws known as Sarbanes-Oxley, there is more standardization/legal cooperation within the world of financial data analysis and reporting. These laws are designed to prevent another situation like, and we’ll say it again – Enron – from happening.

3) For internal decision-making

As mentioned, financial reports are not the best tools for making all internal business decisions. However, they can serve as the ‘bedrock’ for other reports (such as management reports) that CAN and SHOULD be used to make decisions.

These reports must be as accurate as possible – otherwise, any management reports (and ensuing decisions) based on them will be sitting on a shaky foundation. This is where companies can run into trouble, using legacy methods (such as one massive spreadsheet that multiple users have access to) rather than reaping the benefits of reporting by utilizing financial dashboards instead.

In fact, a survey conducted by Deloitte to generate awareness about the value of good financial analytics reporting states that most respondents have identified an “insufficient level of details” as the main issue when it comes to reporting on finances. This is because the techniques and templates used are too old. Modern online dashboards put these problems in the past by providing at-a-glance information on your company's financial health for both yourself and others in a way that is intuitive and detailed.

Remember: the government (and outside investors) don’t care WHY your financial reports are inaccurate. They’ll just penalize you for being wrong – it’s that cut and dry.

4) For improved internal vision,

Things can quickly fall apart if your financial insights or data are fragmented. Financial analysis and reporting are accurate, cohesive, and widely accessible ways of sharing critical financial information throughout your organization. They help answer a host of vital questions on all aspects of your company’s financial activities, giving internal and external stakeholders an accurate, comprehensive snapshot of the strategic and operational metrics they need to make decisions and take informed action.

5) For building strategies and ensuring profitability

Expanding on the previous point, financial analysis and reporting are critical to building informed strategies and ensuring the business stays profitable. In fact, going back to the Deloitte survey we mentioned earlier, 67% of the respondents believe that the information included in their financial statements is key to “identifying effective ways to reduce costs and to eliminate potential losses to maintain profitability.”

That said, these types of reports become critical to the financial health of a business. It allows managers and other stakeholders to build informed strategies to make the company more profitable while empowering every key player to rely on data for decision-making. With the help of modern online reporting software, companies can find trends and patterns in real-time and monitor their income and expenses to allocate resources smartly.

6) For raising capital and performing audits

Financial reporting and analysis assist organizations, regardless of industry, in raising domestic and overseas capital in a well-managed, fluent way – an essential component to ongoing commercial success in today's competitive digital world.

Also, financial analysis and reporting facilitate statutory audits. Statutory auditors are required to audit an organization's financial statements to express their opinion. Reporting tools or software will give this official, concise, accurate, and compliant information – which, of course, is vital.

7) For managing financial ratios

Ratios are essential to a business’s fiscal management initiatives - and there are many to consider. In this context, ratios represent the fine juggling act businesses must perform to ensure the operation runs efficiently.

Financial ratios also help investors break down the colossal data sets accrued by businesses. A ratio gives your information form and direction, facilitating valuable comparisons on different reporting periods.

Displayed visually, modern financial graphs and dashboards provide invaluable performance-based information at a glance, offering essential tools for accurate benchmarking and real-time decision-making.

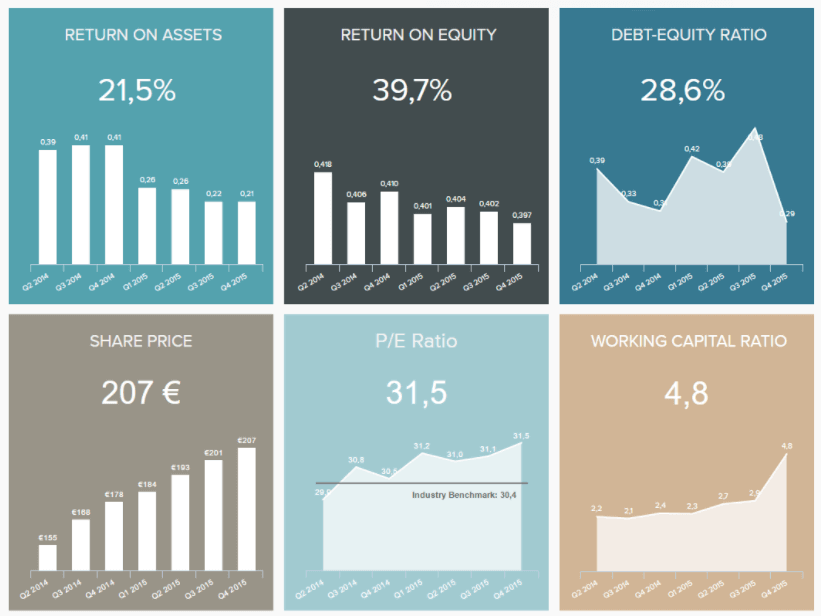

Critical finance analysis ratios include the Working Capital Ratio, Quick Ratio, Return on Equity (ROE), and Berry Ratio. Armed with this wealth of insight, it’s possible to preserve your company’s financial health while developing initiatives that tip the fiscal balance in your favor, boosting your bottom line. The image below is a visual example of financial reporting tracking the quick ratio.

Generated with a professional financial KPI tool, the quick ratio is a metric that tracks the short-term liquidity or near-cash assets that can be turned quickly into cash. The point of this KPI, also known as the acid test ratio, is to include only the assets that can be easily converted into cash, usually within 90 days or so, such as accounts receivable.

8) For accurate projections & predictive strategies

When considering the importance of financial statements to stakeholders, it’s worth mentioning the predictive power of financial analysis.

We’ve explored how financial dashboards offer dynamic visualizations from trend spotting and real-time decision-making. Digging a little deeper, fiscal reporting tools also provide comprehensive insights into a range of financial performance and processes. Historic, real-time, and predictive data combined offer a balanced snapshot of metrics that help users make incredibly accurate projections based on past or emerging trends.

By making projections based on concrete visual data, developing strategies that benefit financial health while nipping any potential issues in the bud is possible.

For example, personal financial management provider Mint.com used predictive analytics to grow its user base and increase its bottom line. Analyzing a mix of consumer data and key financial performance metrics, the company was able to streamline its processes while offering its customers an end goal and working backward.

By providing a predictive goal or aspiration, the business worked in reverse (both internally and externally), developing accurate solutions or strategies that offered the best return on investment (ROI). Not only did this predictive strategy streamline Mint’s internal processes, but the company grew from zero to 1 million subscribers in a relatively short period.

Senior executive Noah Kagan explained the company’s financial triumph:

“Think of it as a road trip. You start with a set destination in mind and then plan your route there. You don’t get in your car and start driving without the hope that you magically end up where you wanted to be.”

9) To lower risk and prevent fraudulent activities

Expanding on our previous point, the depth of data and predictive capabilities of the financial BI dashboard software can significantly mitigate financial risk.

Working with the right mix of metrics, you will begin to see any potential dips in performance or negative patterns unfold intuitively, which means you can take critical actions that prevent potentially devastating monetary calamities.

Armed with dynamic, visual, and interactive KPIs, not only can you mitigate financial risk and protect your company from glaring inefficiencies, but you will also be able to make smarter investments and decisions. Here are some of the KPIs that you should focus on for financial protection and growth:

- Gross Profit Margin

- Net Profit Margin

- Working Capital

- Operating Expense Ratio

- Return on Assets

- Return on Equity

- Cash Conversion Cycle

- Vendor Payment Error Rate

In addition to reducing financial risk across the board, an analytics dashboard can also protect your business from fraudulent activity. And, considering 46% of companies across sectors have fallen victim to financial fraud in the past two years, protecting yourself from internal or external cyber-related crime matters now more than ever.

Through frequent benchmarking and analysis, you will increase your chances of identifying any abnormalities and investigating the matter immediately. This quick response approach will empower you to get to the root of the problem, tackling the issue while reducing further financial damage.

10) To ensure transparency across the board

As we repeatedly mentioned throughout this post, reporting on finances is key to the internal functioning of a business. But not just that, financial statements are also very useful to ensure transparency. For instance, a business working in the public sector might be financed by taxpayers or donors; therefore, they need to be accountable for the way they spend the money they receive. For this purpose, financial reports play a fundamental role since they ensure that public entities are transparent and compliant and that people maintain a relationship of trust with these entities.

Another example is with big enterprises. Customers are becoming more and more critical of the way companies make business decisions today. By making their financial data public and transparent, big enterprises can build stronger relationships with their customers, for example, by showing their charitable actions or sustainability spending. On the other hand, if you offer long-term services, providing information about your company's financial performance can be a reassurance for potential clients that you can stay in business with them for a long time.

In summary, financial analysis and reporting can help businesses of all sizes build trusted relationships with investors, shareholders, employees, and even customers. Clearly communicating that the company is doing well financially can bring several benefits. Let’s look at some of them below.

The Benefits Of Financial Reporting

To continue our journey, let’s consider the key benefits of financially-based reporting and analytics.

- Improved debt management: As you know, debt can cripple the progress of any company, regardless of sector. While there may be many different types of financial reporting and analysis concerning purpose or software, almost all solutions will help you track your current assets divided by the current liabilities on your balance sheet to help gauge your liquidity and manage your debts accordingly.

- Trend identification: Regardless of what area of financial activity you’re looking to track, this kind of reporting will help you identify trends, both past and present, which will empower you to tackle any potential weaknesses while helping you make improvements that will benefit the overall health of your business.

- Real-time tracking: By gaining access to centralized, real-time insights, you will be able to make accurate, informed decisions swiftly, thereby avoiding any potential roadblocks while maintaining your financial fluidity at all times.

- Liabilities: Managing liabilities is critical to your company’s ongoing financial health. Business loans, credit lines, credit cards, and credit extended from vendors are all integral liabilities to manage. Using a financial report template, if you plan to apply for a business expansion loan, you can explore finance data and determine if you need to reduce existing liabilities before making an official application.

- Progress and compliance: As the information served up by financial reporting software is both accurate and robust, not only does access to this level of analytical reporting offer an opportunity to improve your financial efficiency over time, but it will also ensure you remain 100% compliant – which is essential if you want your business to remain active.

- Cash flow: Big or small, an organization’s cash flow is essential to its ongoing financial health. Working with a mix of detailed metrics and KPIs, it’s possible to drill down into cash flow in relation to anticipated profit and liabilities, keeping your monetary movements secure and fluent in the process.

- Communication & data access: Any modern financial report worth its salt is accessible to and optimized for a multitude of devices. By gaining unlimited access to essential financial insights, you can respond to challenges swiftly while improving internal communication across the board. If everyone understands emerging trends and can share vital financial insights, your organization will become more efficient, more innovative, and safeguarded against potential compliance issues or errors.

Who Uses Financial Reporting And Analysis?

We’ve already stated the importance of financial analysis and reporting throughout the post and how they serve as communication tools to keep internal and external stakeholders informed and connected. Financial reports are versatile analytical tools businesses of all sizes use to review their data, stay compliant, and ensure profitability and healthy financial performance. That said, various groups can benefit from financial analysis and reporting for different purposes; some of them include:

- Investors, shareholders, and lenders: Investors and shareholders use financial reports to assess the state of their investments and how the company is generating profit. On the other hand, lenders use them to understand the ability of the company to pay back loans and related interest charges.

- Business Managers: Probably more than any other stakeholder on this list, managers are the ones that can benefit the most from financial reports. Having an efficient financial reporting framework in place allows them to track performance on a deeper level and build smart strategies that will ensure healthy and steady development.

- Regulatory institutions: Tax agents and various governmental entities also gather financial information to monitor that businesses comply with tax regulations. No matter the business size, paying taxes is an obligation that cannot be evaded. Modern financial analysis allows for an organized view of a company's numbers to ensure that all standard procedures are being followed. More on this point later!

- Consumers or customers: Transparency is key in customer relationships. Companies and enterprises use financial reports as open communication with their clients about earnings, investment activities, or charitable donations. On the other hand, customers can also benefit from financial statements when considering which supplier to select for a contract, as they can judge the ability of the supplier to stay in business for a long period of time.

- Employees: Modern financial reporting empowers employees from all departments and levels of knowledge to empower themselves using financial data. Through modern dashboard technology, employees can visualize important financial information to measure the performance of their activities and make informed decisions.

5 Essential Use-Cases For Financial Reporting

Up until now, we’ve looked at things from the big picture. Now, let’s get a little more tangible and down-to-earth by exploring some valuable questions that financial reports (and the reports based on them) can help you answer.

1. Is purchasing this stock a good idea?

If you’re really doing your due diligence on a company you’re considering investing in as an individual or on behalf of your current organization, financial data analysis and reporting can give you some (relatively) “hard” data that will help you make your decision.

This is also one way to gain insight into whether a company is potentially under or overpriced in the stock market.

2. Are we profitable? Will we be in the future?

Without embracing the importance of financial statements, it’s difficult to tell how much your company makes after paying all expenses and payroll. Since a company exists mainly to make profits for itself and its shareholders, this is crucial information – no compromises.

3. How much cash ‘runway’ do we currently possess?

If you’ve ever been a part of the management team of a startup, you might have some idea of how stressful it can be not to know if you’ll be able to ‘make payroll’ in the coming months.

That’s where the importance of financial statements comes in.

Cash is oxygen to a business, and financial reporting analysis can help you see how many months’ payroll your business can give out while remaining financially solvent (assuming that revenue numbers stay the same).

This is a good ‘worst-case scenario’ exercise to conduct regularly – and it’s even more sturdy if you assume that your revenues will fall over the next few months compared to your best guess projections.

4. Do we have the capital to invest in new lines of business?

Some companies, like Apple, like to sit on colossal amounts of cash. Their strategy is to have this money built up so they can remain financially solvent even if some catastrophic things happen to the economy.

However, other companies prefer to invest their money if they can do so while remaining financially healthy. For example, computer chipset manufacturers like Intel upgrade their factories and equipment regularly.

These upgrades are extremely expensive, and while they are a good long-term investment, the company in question must ensure they have the short-term cash flow to support these kinds of moves.

5. Are my vendor relationships as healthy as they should be?

When considering ‘why is financial analysis important?’ it’s always worth considering your vendors. Whether a service- or product-based business, your vendor or supplier relationships are tightly linked to your company’s ongoing financial health.

If your supplier or vendor relationships are strained, inefficient, or fraught with issues, you will stunt organizational productivity, damage your brand reputation, and ultimately, lose money (frequently).

Typically, your vendors or suppliers have individual payment processes and credit rules. Streamlined financial analytics ensures payments and transactions remain fluent at all times, especially if used with a modern client dashboard.

Plus, by working with metrics such as Vendor Payment Error Rate, it's possible to keep track of vendor payments while identifying any under or overpayments during a set timeframe. Accessing this level of insight will optimize your vendor or supplier processes, saving time and money.

3 Different Ways Of Financial Reporting And Analysis

“In a perfect world, investors, board members, and executives would have full confidence in companies’ financial statements… Unfortunately, that’s not what happens in the real world, for several reasons.” – Where Financial Reporting Still Falls Short, The Harvard Business Review article

We won’t get too deep into the ‘financial reporting rabbit hole’ at this point, but we can say with certainty that there are many, many pitfalls associated with this kind of reporting. Some are technical pitfalls, while others are ethical (Enron, anyone?).

Right now, it’s enough to understand that there are three main ways that financial reports are standardized and one critical element to consider when working with EU-based data of any kind:

- The GAAP (Generally Accepted Accounting Principles). This is the system the United States uses, and almost no one else (just like the Imperial measurement system!).

- The IFRS (International Financial Reporting Standards). This system is utilized by more than 110 countries worldwide, including Canada, Australia, India, and China (although China and India have ‘customized’ the IFRS in their own ways).

- The GDPR: (The General Data Protection Regulation): The GDPR came into effect on May 25, 2018, and is designed to modernize the laws that protect the personal information of individuals, which means that if you're handling sensitive financial data of any kind, insights or metrics (involving that of your investors, clients or partners), you must ensure that your reports are compliant.

These differences in standardization have real-world consequences. As the HBR article linked above states:

“Cadbury’s GAAP-based return on equity was 9% — a full five percentage points lower than it was under IFRS (14%). Such differences are large enough to change an acquisition decision.”

6 Common Types Of Financial Reporting

Financial data is not easy to understand, and getting everything together in an infinite Excel sheet makes extracting valuable information from it even harder. With this issue in mind, interactive financial reporting software has been developed to assist businesses in the visualization and analysis of their most important financial information. With technologies such as predictive analytics, automated reporting, and intuitive dashboards, businesses can extract insights in real-time to make important financial decisions.

We’ve already theoretically discussed some common types of financial reports at the beginning of this post. Now, we will cover some visual examples of these types to put their value into perspective. These 5 examples were generated with a professional financial dashboard generator.

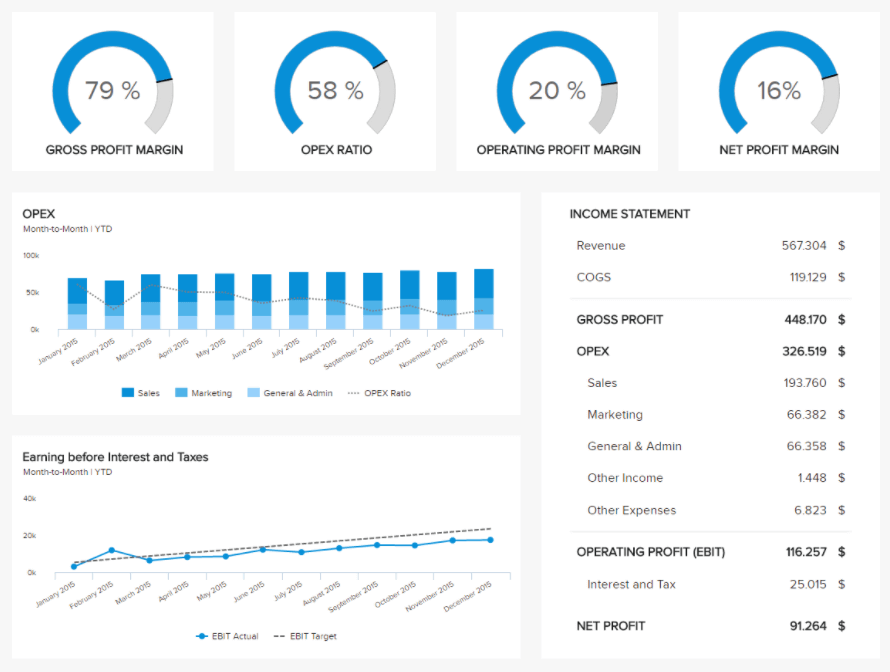

1) Income Statement

This particular financial reporting template tells you how much money a company made (or lost) in a given time period (typically a fiscal year). It does so by showing you revenues earned and expenses paid, with the ultimate goal of showing a company’s profit numbers.

What makes this template so valuable is that it offers a complete overview of the month-to-month performance of the business. For instance, the operating costs (OPEX) are broken down by month and department. This way, decision-makers can spot any inefficiencies and pinpoint the causes and origin to optimize them promptly. Likewise, the earnings before interest and taxes (EBIT) are broken down with a target line to easily evaluate if the business’s finances are developing according to plan.

**click to enlarge**

Primary KPIs:

- Gross Profit Margin Percentage

- Operating Profit Margin Percentage

- Operating Expense Ratio

- Net Profit Margin Percentage

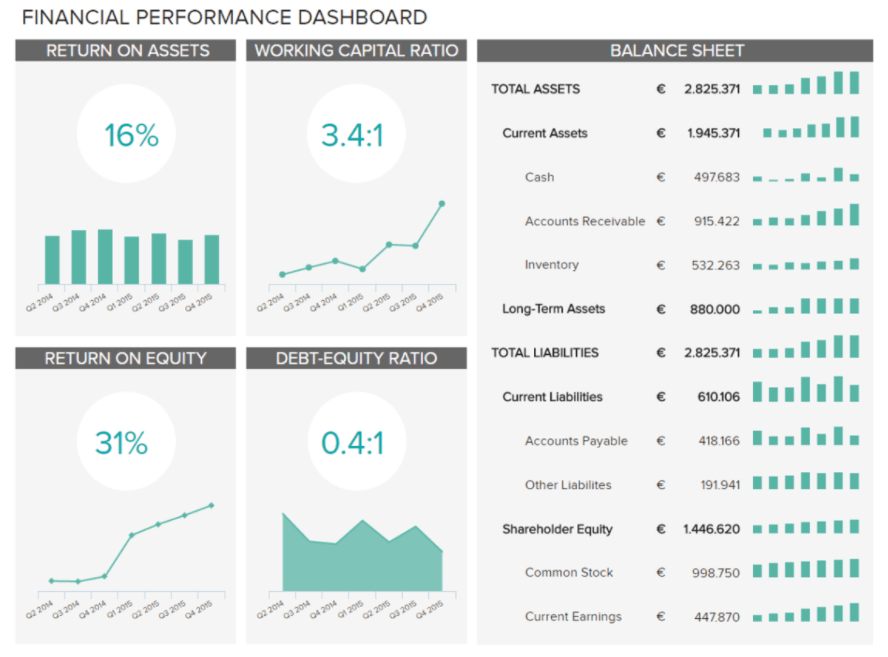

2) Balance Sheet

Moving on with our list of financial reporting examples, we have a balance sheet generated with a professional dashboard builder that offers a snapshot of your assets and liabilities (aka debts) at a given moment in time. It’s possible to fall into bother with your profitability and cash flow situations while having a healthy balance sheet (especially if you have a lot of money tied up in physical inventory), and this report will help you dig deeper, assisting your strategic decision-making.

**click to enlarge**

Primary KPIs:

- Return on Assets

- Return on Equity

- Working Capital

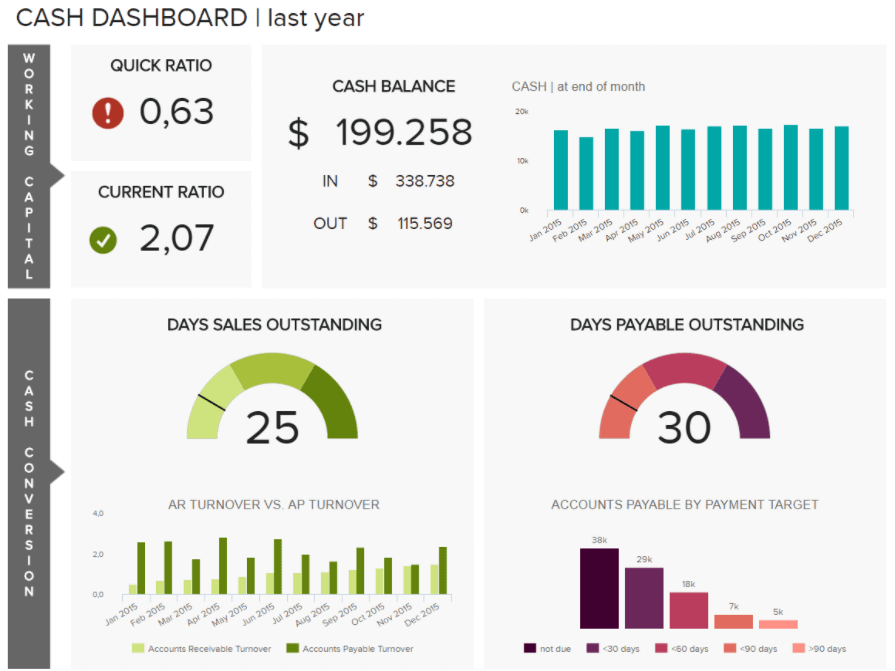

3) Cash Flow Statement

This report shows how much money flowed into and out of your business during a period. The cash flow statement ensures you have enough money to make payroll.

This highly interactive and visually appealing template provides the necessary data to get an overview of your company's liquidity and current cash flow situation. In this case, we can see that the quick ratio is showing a red exclamation mark, which could mean that your company cannot pay the current liabilities with the most liquid assets. To get deeper insights into this situation, the dashboard also offers detailed breakdowns of days sales outstanding and days payable outstanding for the last 12 months, making it possible to find improvement opportunities to drive growth and success.

**click to enlarge**

Primary KPIs:

- Current Ratio

- Accounts Payable Turnover

- Accounts Receivable Turnover

Our next two financial analysis report examples are full dashboards that host a mix of visual metrics and KPIs, offering a complete picture of a company’s fiscal activities in action. Let’s take a look.

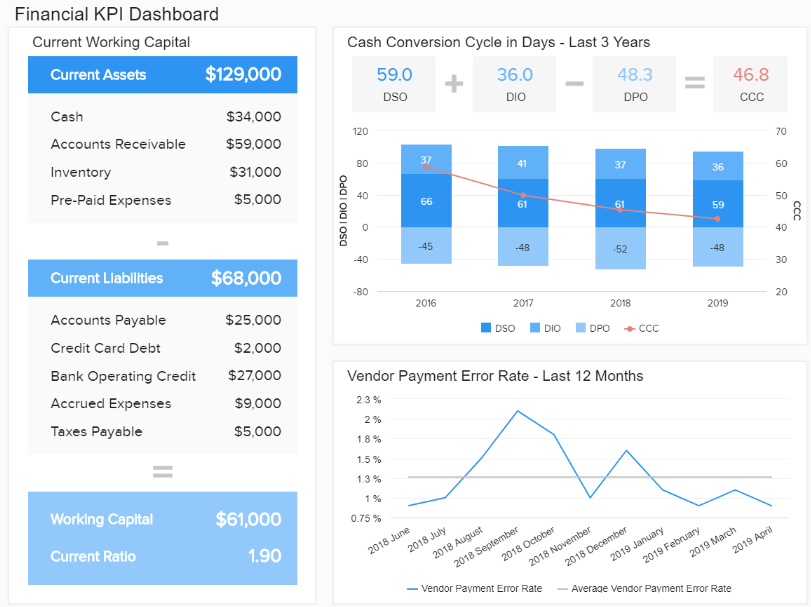

4) Financial KPI Dashboard

Offering an essential snapshot of vital financial performance data, a robust financial KPI dashboard offers a cohesive mix of tables, graphs, and charts designed to maintain fiscal health. Working with KPIs such as Working Capital, Cash Conversion Cycle, Budget Variance, and more, this dynamic financial reporting system will empower you to reduce inefficiencies, make accurate forecasts, and keep cash flowing through the organization effectively.

**click to enlarge**

Primary KPIs:

- Working Capital

- Quick Ratio / Acid Test

- Cash Conversion Cycle

- Vendor Payment Error Rate

- Budget Variance

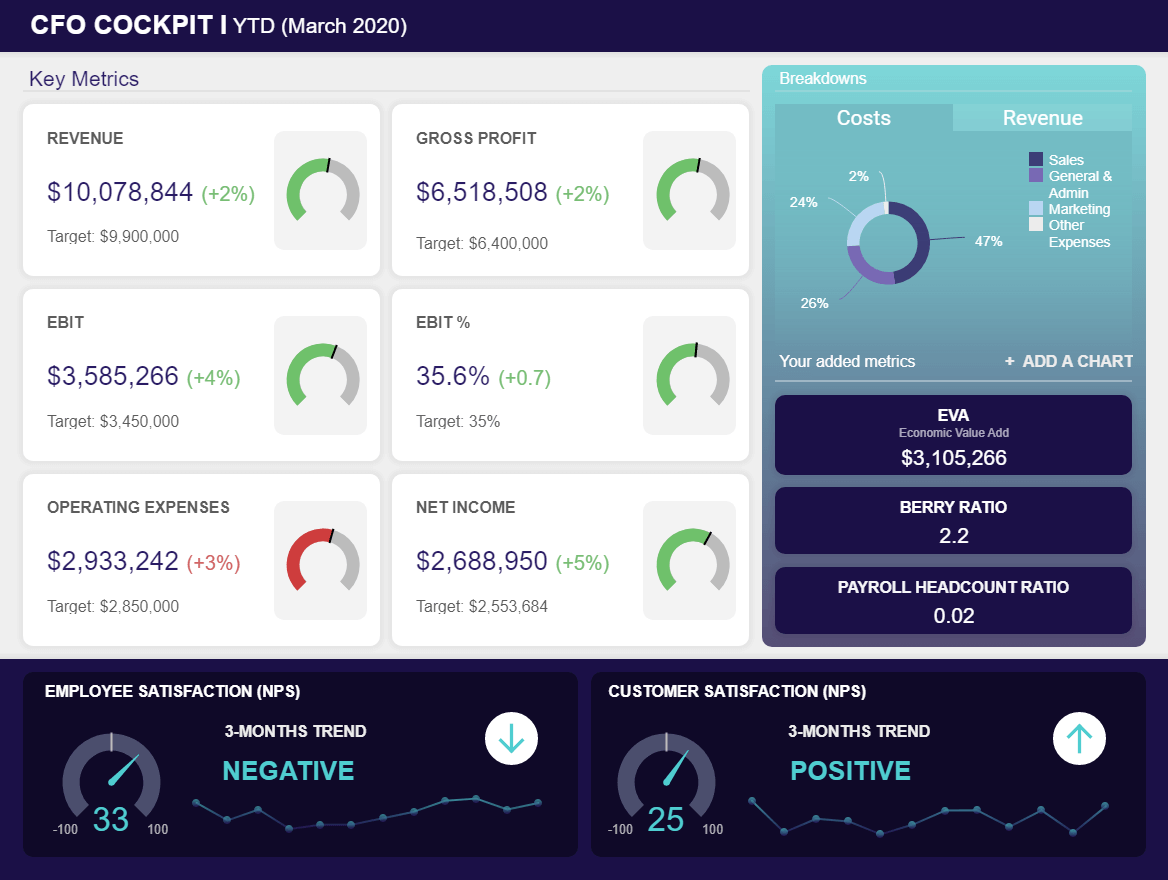

5) CFO Dashboard

Also known as the ‘CFO cockpit,’ this powerful CFO dashboard provides a digestible glance at high-level fiscal metrics and essential economic trends. With detailed insights into employee satisfaction and the Berry Ratio, here you will find everything you need as a senior decision-maker to identify emerging trends, make informed organizational decisions, and consistently meet (or even exceed) your profit targets.

**click to enlarge**

Primary KPIs:

- Payroll Headcount Ratio

- Economic Value Added (EVA)

- Berry Ratio

- Employee Satisfaction

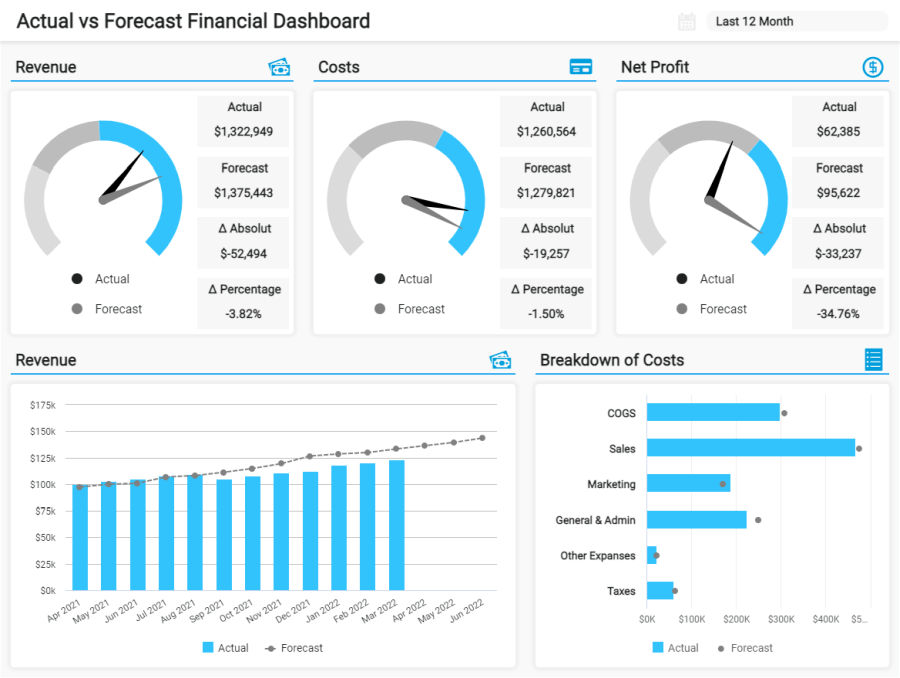

6) Accurate vs Forecast Dashboard

At first glance, this financial reporting dashboard offers all the same indicators as an income statement. However, this information is complemented with valuable forecasts for costs and income. Considering the fast-paced nature of the current business landscape, getting an accurate picture of what will happen in the future becomes an invaluable competitive advantage.

The dashboard offers insights into 3 key areas: revenue, costs, and net profit. Each of them is depicted with the actual and forecasted value for the last 12 months and the absolute variance in dollars and a percentage. How accurate the absolute difference is will depend on the organization's goals and how close they are to the forecast. However, they still represent an accurate picture to make important decisions about budgeting and other processes.

In the lower part of the example, the metrics are broken down by month and compared to the forecast. This is valuable input, allowing us to dig deeper into the data. For instance, the cost breakdown shows all departments stayed within the expected spending, except for marketing. In that scenario, it would be smart to analyze whether those extra costs are justified.

**click to enlarge**

Primary KPIs:

- Actual vs Forecast Income

- Actual vs Forecast Expenses

What Should a Successful Financial Reporting System Include?

So far, we have gone through benefits, examples, use cases, and much more valuable information regarding financial reporting requirements and processes. To finalize this insightful guide, we will review some key elements a successful financial reporting system should include.

In the past, the tools and techniques used to generate these reports were static, making the process different from today's. Whereas, in the past, report generation required a lot of time and manual work, today, reports are generated with live data that enables businesses to make important decisions in real time. That being said, below, we will present a few key elements to success in today’s modern business landscape.

Real-time data: As mentioned, one of the key elements of such a system is the presence of real-time data. Tracking every last detail of your financial performance as soon as it occurs enables you to make strategic decisions that will drive success and significantly mitigate risks. For instance, you can allocate resources smartly based on live trends or control expenses that are not going as planned and might bring negative consequences in the future, among many other things.

Predictive analytics is another element that has become fundamental for businesses wanting to extract the maximum potential from their financial data. This technology uses a mix of current and historical data to extract patterns and trends from financial information and generate accurate forecasts about future performance. This helps businesses predict and optimize several processes, such as anticipating future product demand or identifying potential loss drivers, among others.

Automation: Traditional financial reporting and analysis requires endless hours of manual work not only on generating the actual report but also on data collection, classification, and analysis. This made the process way less efficient, as by the time a report was finished, its data might not be valuable anymore. That’s why automation has become a key requirement. Being able to automatically generate reports with live data leaves decision-makers enough time to focus on other important tasks while significantly mitigating the risk of human error from manually generating a report.

Accessibility and collaboration: For a company’s financial goals to be achieved, it is necessary to involve all departments and relevant stakeholders in the process. This is possible thanks to the level of accessibility and collaboration provided by modern financial analytics software such as datapine. Reports are generated using interactive data visualizations that make the data in them easier to understand for non-technical users. Plus, they can be easily shared in multiple formats to support meetings and discussions.

Financial Analysis And Reporting Trends

As you learned by now, the financial analysis and reporting industry never stops evolving. New technologies and innovations emerge each year to help companies keep up with their competitors and the changing regulatory landscape. To help you stay current, we will discuss the top trends you should be aware of below. Starting with cloud-based solutions.

- Cloud based-solutions

The first, arguably the most important, trend we will discuss is adopting cloud-based solutions. Traditionally, businesses have relied on desktop-based tools to manage their financial data and generate reports. As we mentioned earlier in the post, this was inefficient and subject to critical security issues.

With this situation in mind, and mostly due to security concerns, we can expect to see more and more businesses turning to the cloud as a way to improve their data management process with enhanced scalability, security, automation, and real-time updates. The online nature of cloud BI solutions makes it possible for businesses to access their data more easily and collaborate with other stakeholders, improving the quality and accuracy of financial reports.

- XBRL reporting

According to Investopedia, eXtensible Business Reporting Language (XBRL) is defined as a “software standard that was developed to improve the way in which financial data is communicated.” It is basically an international standardized language that enables businesses to extract and share human-readable financial data in a format that machines can process.

XBRL was born out of a necessity to unify financial data for comparisons and better accessibility. That is why, in the coming years, we can expect regulators to ask businesses to implement XBRL reporting into their financial statements as a mandatory practice. The standard is already being used in over 50 countries, replacing paper, PDF, and HTML-based reports.

So, how does XBRL work? XBRL enables businesses to add tags to each data element from their reports within a taxonomy. A taxonomy is a grouping of financial concepts known as "elements." Each element is defined as a concept, and the different relationships between the concepts. Doing so enables regulators and any other user of the data to analyze and compare it easily as all reports will have the same format and tags, making it a global financial language.

- Sustainability reporting

We already talked a bit about ESG reporting earlier in the post, and we can tell you it is one of the most important and fastest-growing trends in the finance world at the moment. The popularity of this trend comes from customers, investors, and regulators increasingly demanding businesses of all sizes take responsibility and accountability for their environmental impact. This involves not only direct damage to the environment but also fair labor, social justice, and ethical governance.

In 2024 and beyond, we can expect businesses to complement their financial reports with the different initiatives and goals they are implementing to ensure sustainability and compliance. As more and more laws and regulations come out and more businesses realize that sustainability factors can impact the company’s performance, we will see ESG reporting as a fundamental pillar for success.

- Artificial Intelligence

Artificial intelligence has permeated industries across the globe in the past few years, and finances are no exception. This year, we will see more companies adopt AI into their reporting as a way to automate tasks like data collection, analysis, and report generation. Not just that, but some data analysis software have already implemented AI in the form of intelligent assistants that help organizations extract insights, predictions, and recommendations to help make smart strategic decisions and ensure healthy finances and steady growth.

Using artificial intelligence in finances can help make more efficient and accurate decisions at a lower cost and with less manual risk.

So, What Is The Purpose Of Financial Reporting?

To reiterate: What is the importance of financial reporting? Thoughts or feelings aside, financial reports will be around as long as businesses are trading.

Why? Governments will never stop collecting taxes and commanding compliance. Across sectors, businesses will always need to track their fiscal activities with pinpoint accuracy - and finance data reporting is the best way to do so.

In addition to paying taxes and remaining compliant in the eyes of the law, financial reporting tools allow businesses to make their fiscal activities all the more strategic, streamlined, and forward-thinking. In that sense, these tools are both functional and progressive, empowering users to accelerate the growth of their businesses by taking charge of their financial health.

While you may not be able to choose if or how you prepare financial reports, you can at least take control of how you present them. With a financial, real-time dashboard, you can see your company’s financial integrity at a glance, empowering you to make better choices while responding to constant change.

To get started with finance-based reporting, try our financial analytics software with a free 14-day trial. It’s time to take your business to the next level.