Your Introduction To CFO Dashboards & Reports In The Digital Age

Table of Contents

3) CFO Dashboard Report Examples

4) CFO Dashboard KPIs & Metrics

As a chief financial officer (CFO), the weight of your company's fiscal well-being most likely rests on your shoulders. That’s a lot of pressure, to say the least. Not only are you responsible for the ongoing financial strategy of your organization, but you're probably expected to provide timely, accurate insights to a variety of stakeholders.

With so much responsibility and such little time, financial data analysis is no easy feat. But, while working efficiently with fiscal data was once a colossal challenge, we live in the digital age and have incredible solutions available to us.

CFO dashboards exist to enhance the strategic as well as the analytical efforts related to every financial aspect of your organization.

CFO reports will supercharge your financial initiatives. Here, we’ll explore the dynamics of reports for CFOs, consider their business-boosting power, look at CFO reporting tools, and consider real-world examples of both CFO dashboards and reports.

Let’s get started.

What Is A CFO Dashboard?

A CFO dashboard is an analytical tool that offers a centralized location for a company’s most critical financial KPIs and data in real-time. Through them, decision-makers get a complete picture of their fiscal health and identify potential risks and improvement opportunities.

A CFO dashboard tool provides a panoramic view of all of the information an ambitious modern CFO needs to perform their job to the best of their abilities. It also houses essential reports for CEOs through powerful financial dashboards. In essence, a CFO dashboard is the analytical nerve center for all of your most invaluable financial data.

What Is A CFO Report?

CFO reports provide a mix of visual KPIs geared toward helping financial officers make confident, informed decisions based on a variety of core financial activities. Reports are usually shared through a dashboard, public URL, or embedded into an existing application.

If you’re using CFO dashboards for financial business intelligence, they will play host to detailed analytical reports that serve up a mix of past, predictive, and real-time insights.

If a CFO KPI dashboard is the analytical framework, the visual insights contained within the tool are your analytical eyes. With the right CFO report template, you can access priceless fiscal information that will help you streamline your monetary activities, enhance your strategies, help you benchmark your goals, and improve the way you communicate essential insights with your stakeholders, both internal and external. Let's see this through an example.

We offer a 14-day free trial. Benefit from professional CFO reports!

CFO Dashboard Report Examples

Now that you know what to include in your reporting tools and why you need them for increased financial success, it’s time to look at a real-world CFO dashboard example—our specialist CFO-centric dashboard report, to be precise.

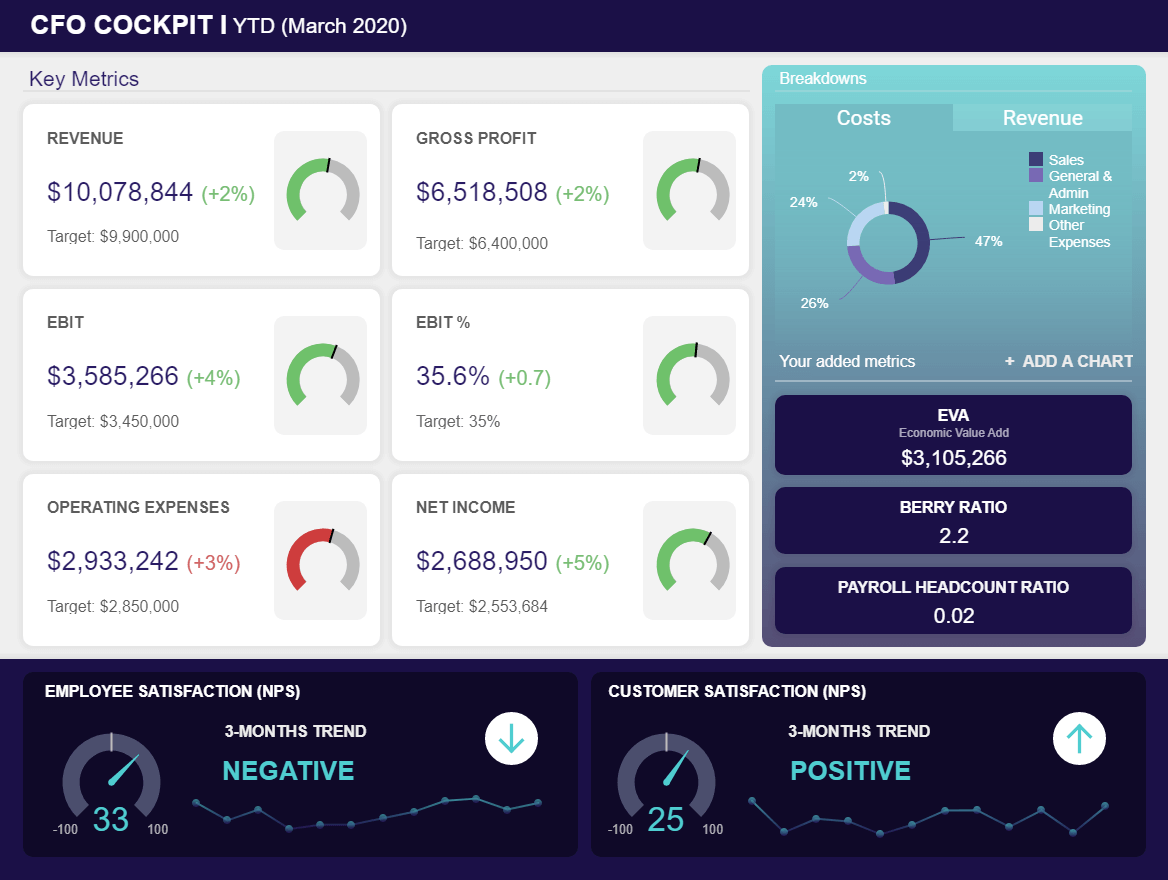

1. CFO Cockpit Dashboard

**click to enlarge**

Primary KPIs:

- Payroll Headcount Ratio

- Economic Value Added (EVA)

- Berry Ratio

- Employee Satisfaction

This most essential of CFO dashboard examples drills into the four key financial areas that are most relevant to modern chief financial officers: costs, sales goals, gross profit, as well as employee and customer satisfaction metrics.

This powerful CFO dashboard sample allows you to connect another dashboard within its framework with ease while integrating additional insights, including market indicators, consumer analysis, investor relations, monetary management, and more. The metrics featured at the top left of this cutting-edge CFO report template include cover gross profit, EBIT, operational expenses, and net income — a perfect storm of financial information.

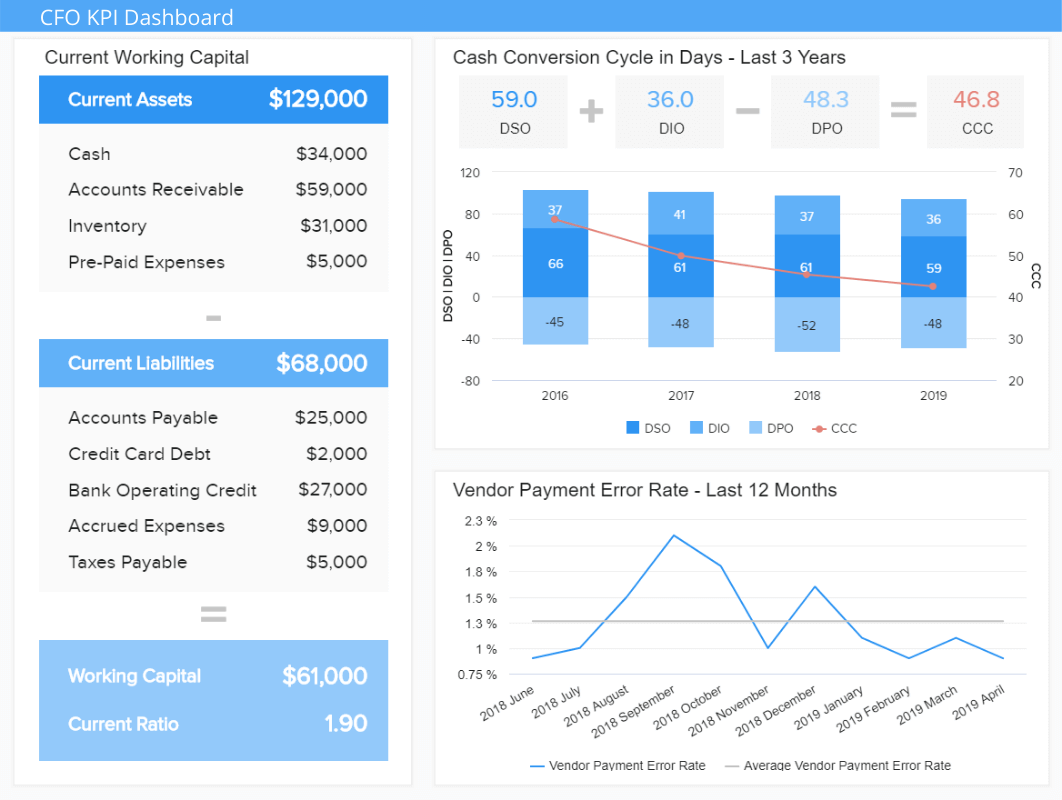

2. CFO KPI Dashboard

**click to enlarge**

Primary KPIs:

- Working Capital

- Quick Ratio / Acid Test

- Cash Conversion Cycle

- Vendor Payment Error Rate

- Budget Variance

The next of our CFO reporting templates is an essential analytics tool for any financial decision-maker.

Our CFO KPI dashboard is armed with a cohesive mix of visual metrics designed to help you make informed top-level financial decisions with a quick glance. This powerful CFO KPI dashboard offers deep-dive insights into essential fiscal aspects, including cash conversion cycle, working capital, and budget variance.

This perfect storm of KPIs will aid the creation of business-boosting financial strategies, keep unnecessary operational costs to a minimum, and streamline processes for optimal fiscal success.

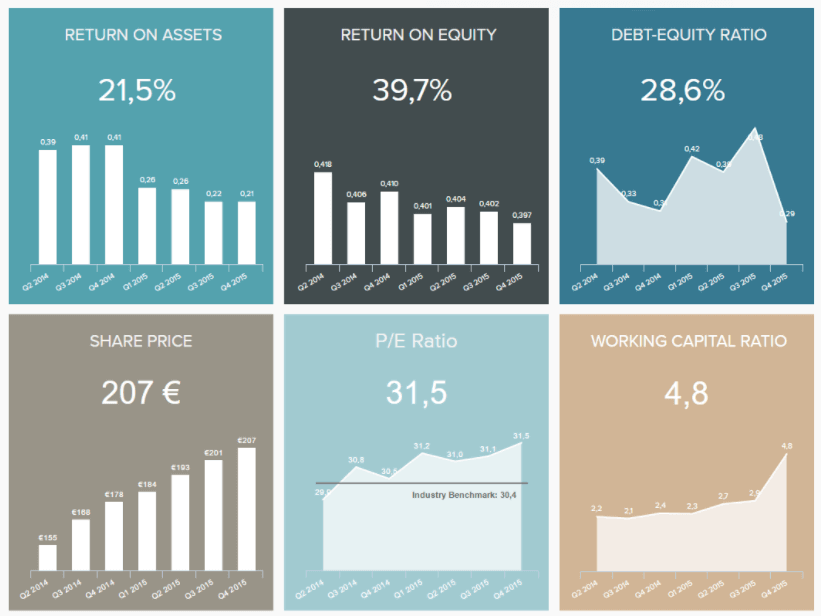

3. Investor Relations CFO Dashboard

**click to enlarge**

Primary KPIs:

- Return on Assets

- Return on Equity

- P/E Ratio

As a financial manager, maintaining investor relationships is no doubt a top priority. This CFO report developed to make insights around assets, equity, and business valuation is a visually balanced investor relations dashboard that makes another powerful tool for any senior financial decision-maker.

By working with modern CFO performance metrics, every chief financial officer, regardless of sector, can gain a clear snapshot of the company’s fiscal health and status across the board.

With CFO analytics, you can see how you performed against specific benchmarks and get an accurate gauge of how your operational expenses stack up (whether you’re on track, exceeding your targets, or if you need to cut costs).

Armed with access to these powerful CFO-centric insights, you will be able to start asking the right questions while identifying potential strengths, weaknesses, or trends that will ultimately accelerate the success of your business while increasing financial efficiency in a number of critical areas.

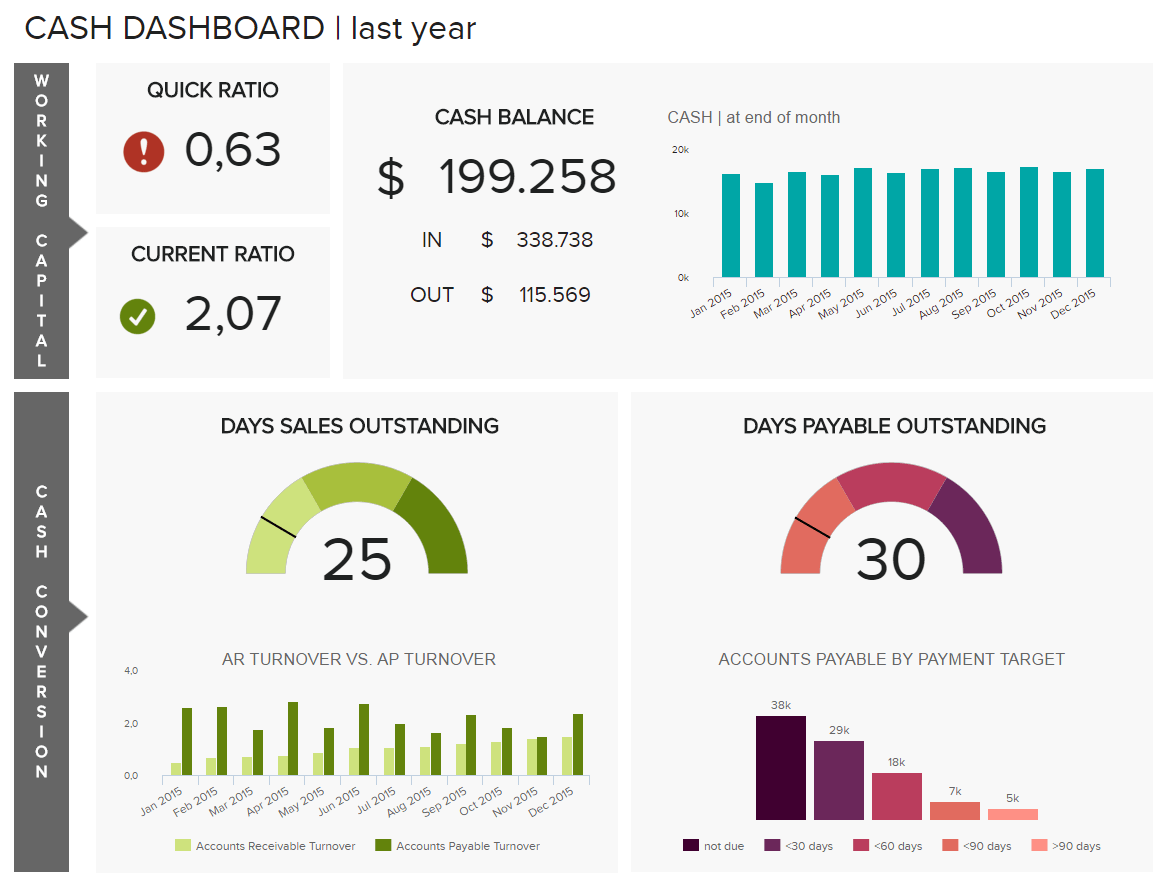

4. CFO Cash Management Dashboard

**click to enlarge**

Primary KPIs:

- Current Ratio

- Accounts Payable Turnover

- Accounts Receivable Turnover

Our next CFO analytics dashboard hones in on effective cash management. With a balanced mix of interactive KPIs that bounce off the page, here you have everything at your disposal to measure your company’s liquidity and cash flow with pinpoint accuracy.

With CFO metrics based on accounts turnover as well as your ability to cover your assets or obligations in the short term, this interactive template will help keep your fiscal health flowing throughout the year.

These dynamic metrics will empower you to set accurate benchmarks based on how you can reimburse suppliers, how swiftly you collect payments and your overall fiscal fluency at a base level. Gaining access to this deep-dive level of knowledge will ensure you keep evolving and progressing while dealing with any kinks in your company’s cash flow situation.

This particular tool features real-time insights, it’s perfect for nipping any spiritual cash flow issues in the bud while making valuable fiscal decisions under pressure. As a head fiscal officer, you have to juggle a multitude of tasks, and this powerful tool will make you more confident as well as more efficient.

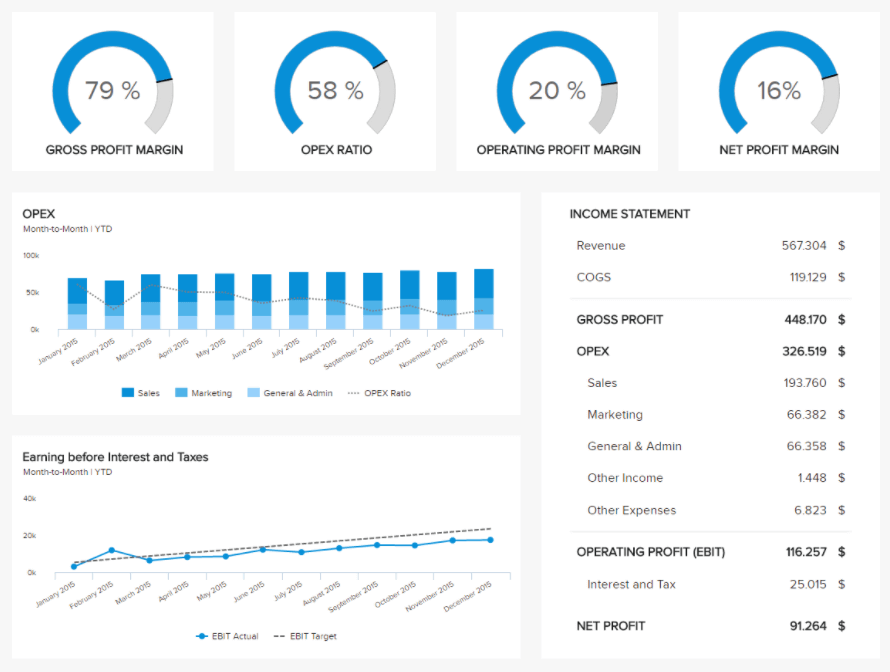

5. CFO Profit and Loss Dashboard

**click to enlarge**

Primary KPIs:

- Gross Profit Margin Percentage

- Operating Profit Margin Percentage

- Operating Expense Ratio

- Net Profit Margin Percentage

As a chief fiscal officer, managing as well as measuring your profits and loss is vital to the role. Without a dynamic means of quantifying and understanding critical fiscal details, your strategy will start to unravel quickly.

This powerful CFO reporting tool will give you access to a wealth of valuable information including a detailed live income statement, trend-based visuals on earnings before tax or interest deductions, and accessible percentages on a balanced mix of fiscal margins or ratios.

Here you can break down your expenses related to every key department or function to gain an objective understanding of outgoings as well as your primary profits. Being able to explore these trends and patterns at a glance will help you make informed choices concerning how you distribute your resources and budgets as well as how you tackle fiscal troughs during particular periods of the year. Essentially, this data-driven tool is about achieving as well as maintaining fiscal harmony across the board, and as such, it’s an essential part of any modern finance officer’s toolkit.

We offer a 14-day free trial. Benefit from professional CFO reports!

Top 20 CFO Dashboard KPIs & Metrics Explained

Now that we’ve explored one of our most effective examples of CFO reports, we’re going to take a quick glimpse at seven of its pivotal financial graphs, starting with the gross profit margin percentage. We have also included satisfaction metrics as, nowadays, CFOs don't track financial KPIs only, but also have responsibility for other organizational areas. Let's take a closer look at our dashboards and see what that means.

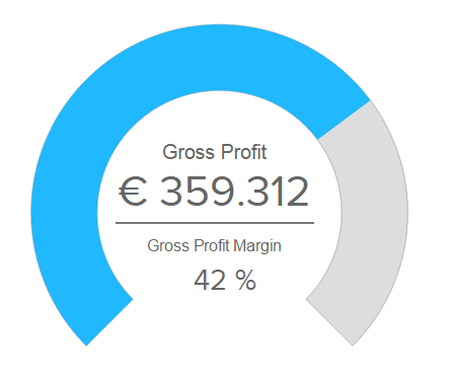

1. Gross profit margin percentage:

One of the critical KPIs for CFO, the gross profit margin, expressed in percentage, will tell you how much of the total sales revenue you keep after accounting for all direct costs associated with the production process (or delivered service).

This is one of the high-level CFO metrics that need to be monitored in order to see a bigger picture of acquiring your income. In essence, the bigger the margin, the more income you can retain.

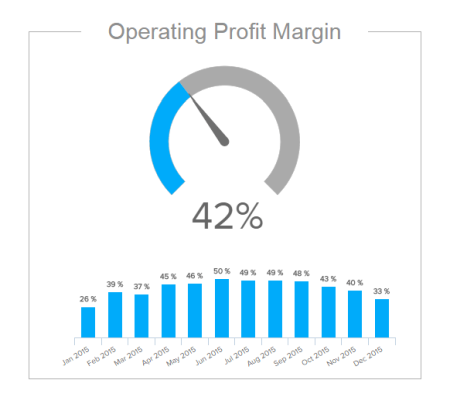

2. Operating profit margin:

Also referred to as earnings before interests and tax, this CFO KPI demonstrates what's left from the revenue after paying all operational costs.

By monitoring this important metric, you will be able to quickly identify if the number is declining and, consequently, take immediate action.

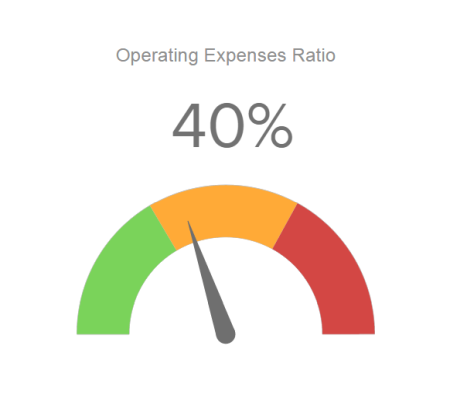

3. Operating expense ratio:

The operating expense ratio is a metric that will info you whether your business is scalable or not. For example, if you can increase sales without increasing operating expenses.

It's important to monitor this CFO metric as it will show you the level of operational efficiency which you can always improve over time and try to lower the expenses.

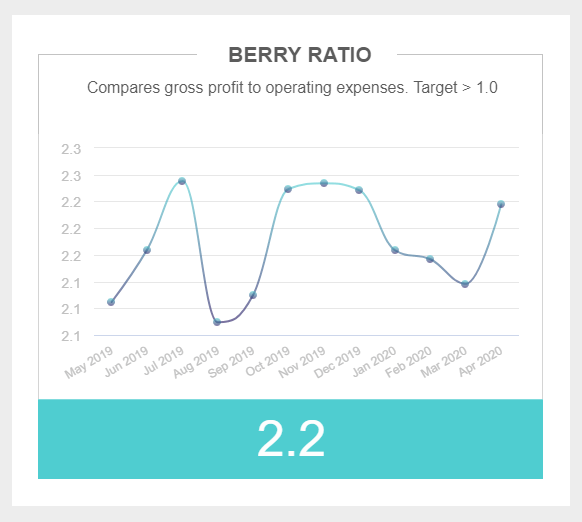

4. Berry ratio:

When you’re talking about a fiscal report to the CEO or about a CFO report to the board of directors, the berry ratio is a KPI that will prove very effective.

The berry ratio is a CFO KPI that visualizes and quantifies the ratio of gross profit in relation to operating expenses. By tracking as well as benchmarking this on a regular basis, you can provide an accurate snapshot of the company’s overall financial health —something you will need to maintain indefinitely.

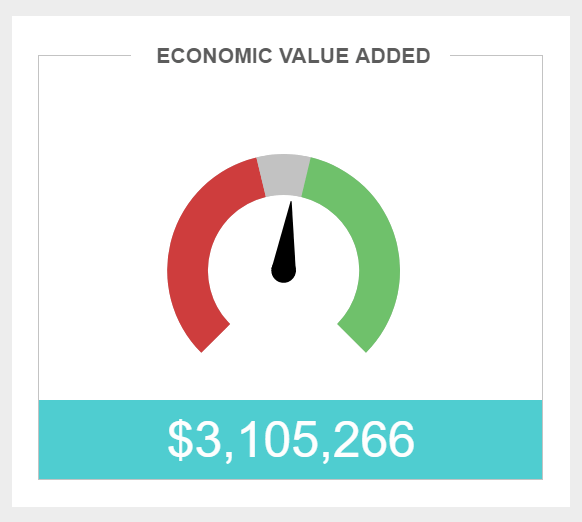

5. EVA:

EVA, or economic value added, is a fundamental part of financial reports as it provides a precise estimate of your company's economic profit that is surplus to the required return of the company's shareholders.

EVA is a metric that not only offers a wealth of information but is also likely to be in hot demand for any modern CFO.

6. Employee satisfaction:

Employee satisfaction is as important as customer satisfaction, and the best software for CFOs will always include this CFO metric somewhere in the mix.

Whether you're talking monthly or daily insights for CFOs, employee satisfaction is something you must monitor closely as it will affect performance and productivity, which, in turn, will have a significant financial impact on the organization. As mentioned, satisfaction metrics are not "hard" financial metrics, but important for each modern financial officer that needs to obtain a birds-eye view of the overall organization.

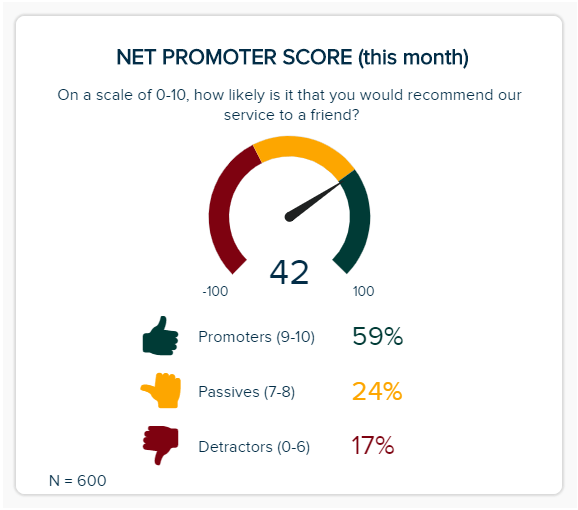

7. Customer satisfaction

Our next example is a customer service KPI aiming to monitor satisfaction rates through the Net Promoter Score. Customers are the beating heart of any business, and especially important for CFOs since the financial health of a company is completely reliant on customers. If they're not satisfied, the company can suffer huge financial losses.

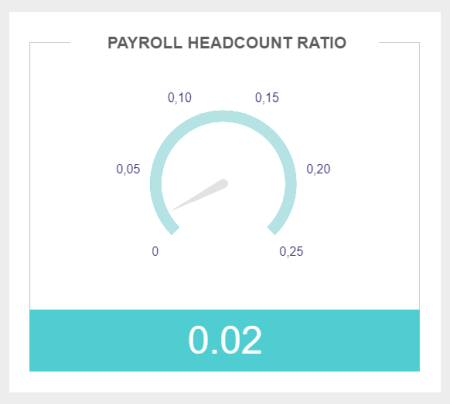

8. Payroll headcount ratio

An effective way of identifying and reducing unnecessary labor costs, the payroll headcount ratio offers a clear indication of how many workers are engaged in the payroll process compared to your total number of employees. By keeping this CFO analytics dashboard low, you will maintain consistently high levels of productivity while earning a healthy ROI for your staffing efforts.

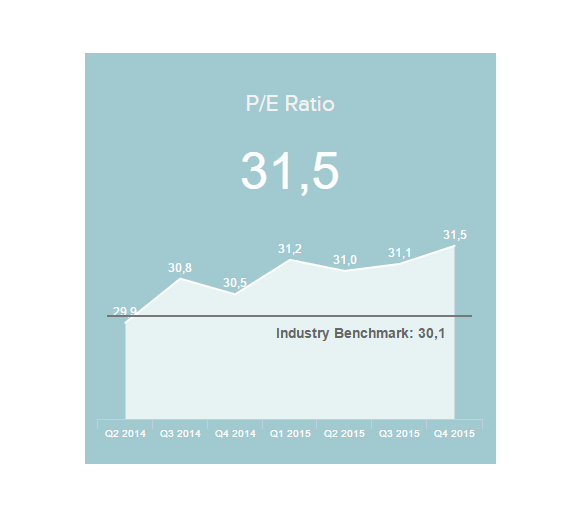

9. P/E Ratio

One of the most powerful investor relationship CFO KPIs, the P/E ratio provides a definitive view of your Earnings Per Share - or company valuation - in comparison to others in your industry. Naturally, the parameters will vary depending on your industry or business model, but by tracking this metric regularly, you can take the right strategic measures to enhance your company’s investability.

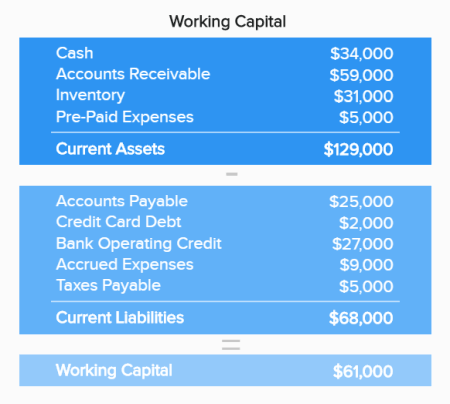

10. Working capital

One of the CFO dashboard KPIs that every top-level financial leader should have in their analytical toolkit, working capital is a powerful means of benchmarking your business’s overall financial health. Rather than a chart or ratio, this most powerful of CFO dashboard metrics presents prime fiscal numbers in a logical, digestible format. Here, you can see a breakdown of costs and liabilities as well as a quick-glance calculation of your company’s working capital at any given time. It’s a swift and efficient way to examine general financial performance and take appropriate strategic action if required.

We offer a 14-day free trial. Benefit from professional CFO reports!

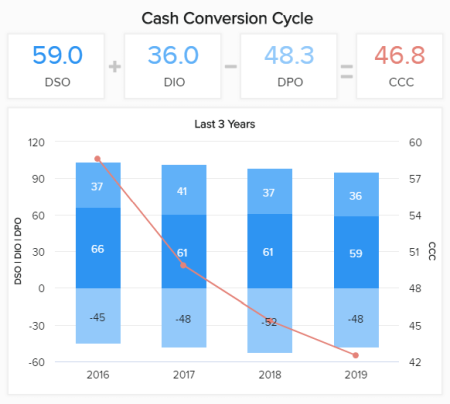

11. Cash conversion cycle

Developed to show how quickly your business can convert its resources into profits or cash, the CCC metric is an essential element of any effective CFO dashboard. Working with this powerful KPI, you can benchmark your performance against previous financial years, accurately gauging the efficiency of your various fiscal processes. The aim here is to create a steady rise or gain, taking action to formulate cashflow-centric management strategies if you witness any sharp spikes or falls in your CCC numbers.

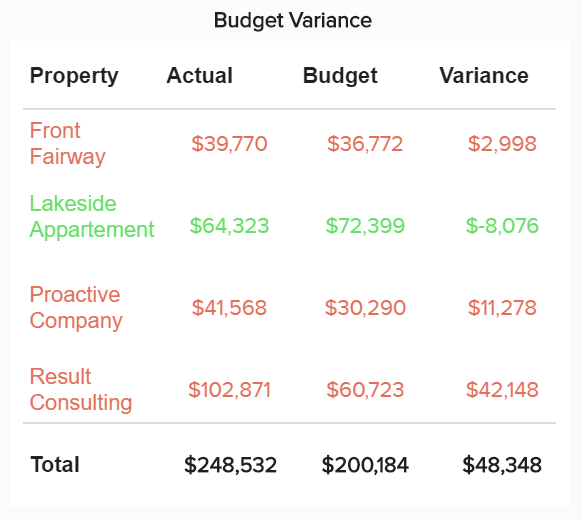

12. Budget variance

One of our most practical CFO financial metrics, budget variance offers an objective glance at how realistic and accurate your budget really is, accounting for every operational variation from natural disasters and fluctuating organizational conditions to poorly planned forecasting, ongoing labor costs, and beyond. This comprehensive breakdown of actual costs to the projected budget is an incredibly effective means of tweaking or optimizing your various financial initiatives for ongoing growth and consistent financial health.

13. Cost of goods sold (COGs)

This most valuable of CFO performance metrics is based on the costs of any goods that are either made or purchased in-house and then sold to partners or customers. In this sense, COGs are essentially a form of business expense and it impacts how much profit you make on your goods or products. Working with this KPI is not only a prime means of maintaining a firm grasp of vital business expenses, but it’s also a tax reporting requirement. As such, monitoring your COGs in an interactive visual format will empower you to remain accurate, progressive, and compliant at all times.

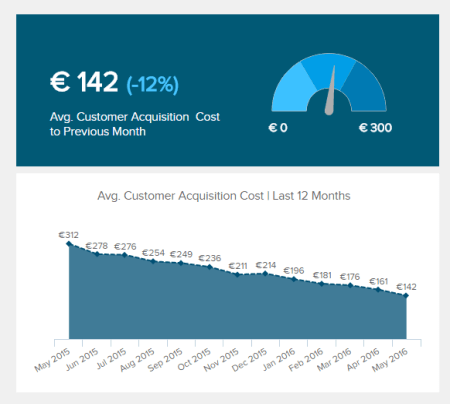

14. Customer acquisition costs

Your customer acquisition cost - or CAC - should feature in your CFO dashboard as it will give you, as well as your investors, the intelligence to understand how these figures move over time. Setting a solid target or benchmark will empower you to develop water-tight strategies to drive your acquisition costs over time and keep them at a healthy figure. As an ever-evolving process, having the visual tools to track your CAC with pinpoint accuracy will help you make targeted tweaks that boost your fiscal health significantly, allowing you to grow your audience as efficiently as possible.

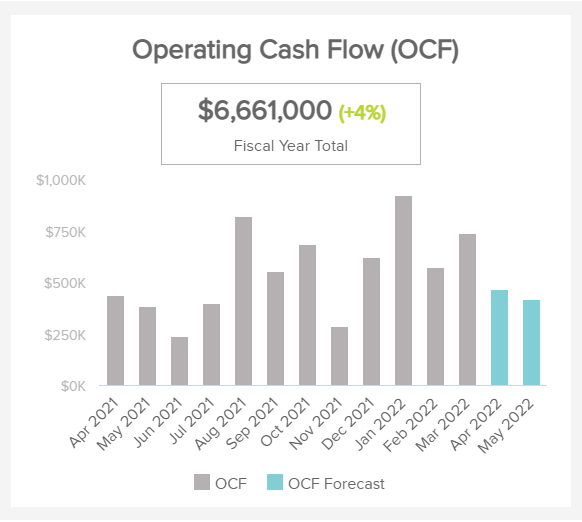

15. Operating cash flow

For CFO dashboards that offer real organization-boosting insight, taking charge of your operating cash flow (OCF) is vital. This digestible trend-based metric will serve as a data-driven ace up your sleeve as it will give you an objective overview of your fiscal total while breaking actual as well as forecasted data across a specific timeframe. Your OCF represents the amount of cash the company has generated based on your core or ‘regular’ activities or operations. If you begin to see any traces of negative cash flow, you can nip the issue in the bud immediately, keeping everything healthy and balanced in the process.

16. EBITDA & EBITDA growth

These may be a mouthful as far as acronyms go, but they are an essential part of any senior decision-maker data-driven toolkit. EBITDA stands for ‘earnings before interest, tax, depreciation, and amortization’ and it gives an objective measure of a company’s operating performance. EBITDA growth will offer an accurate representation of your company’s ability to scale in terms of financial growth and profitability. It’s an alternative or an addition to basic earnings or net income data and as such, offers another clear-cut insight into your company’s fiscally-based foundations.

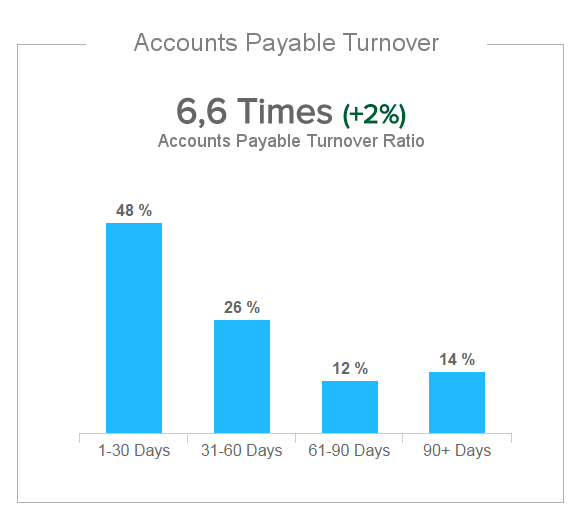

17. Accounts payable turnover

The next of our CFO report example metrics is the accounts payable turnover. This highly-accessible bar chart is worth tracking as it provides an accurate breakdown of your turnover ratios over different time frames. Working with this critical metric, you can continue answering the critical question, “am I paying my expenses back at a reasonable rate?” Deciding on a water-tight benchmark will give you the perspective you need to ensure you can pay your suppliers, vendors, or additional partners back at a steady momentum. Another critical metric for any senior fiscal decision maker’s analytical toolkit.

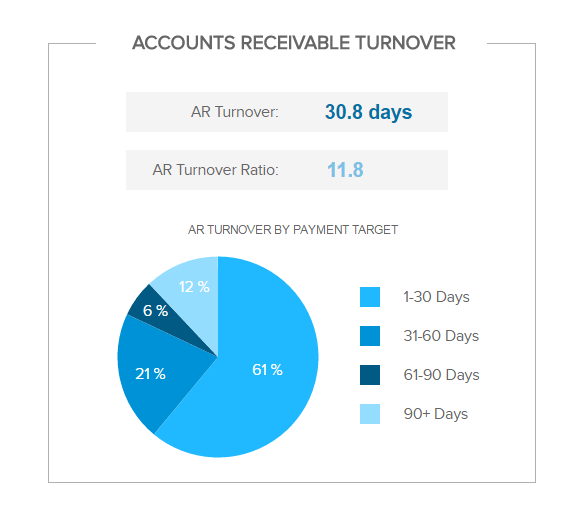

18. Accounts receivable turnover

All solid CFO reports feature reliable turnover-based information. Monitoring your accounts receivable turnover is critical because it will give you a panoramic overview of how you manage to collect important payments from the likes of partners or suppliers. Here you can see your AR turnover rate, your AR turnover ratio, and how often you are hitting your target over specific timeframes. If you notice an upturn in your company’s ratio (if it starts to soar over time), you can take immediate measures to discuss as well as revise your company’s key credit policies in a way that will restore harmony and balance to your AR activities.

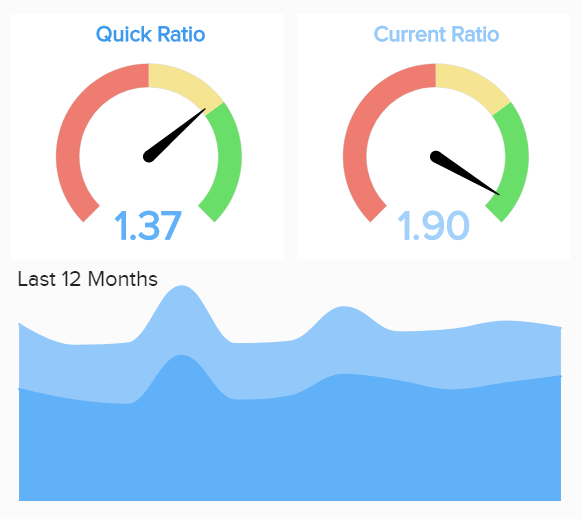

19. Quick ratio

This particular metric is designed to offer an objective insight into the health of your company’s liquidity over a 12-month period. By taking into account your ‘near-cash assets’, this savvy KPI will give you a clear-cut insight into what short-term positions you can convert into actual cash. This ratio shows the assets you can utilize in a practical sense, usually over a 90-day period. The aim here is to have your ratio sitting around a healthy level, representative of your liquidity benchmarks to ensure your company’s monetary health remains fluent. Keeping a keen eye on this particular KPI is critical to keeping your liquidity intact throughout the year.

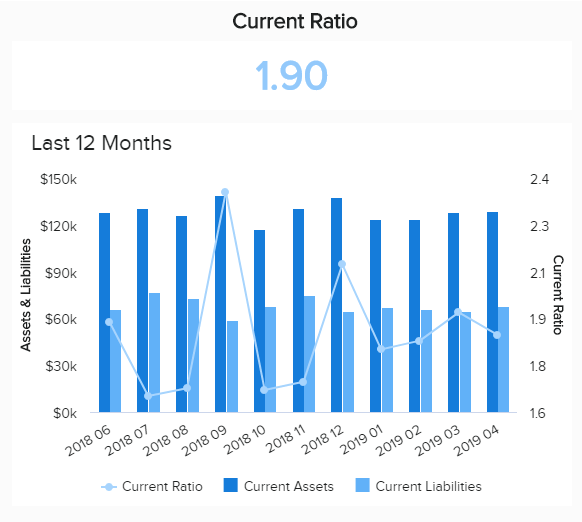

20. Current ratio

Last but not least in our KPI examples we have the current ratio. Your current ratio shows trend-based data on how you can handle your short-term fiscal obligations based on assets and liabilities. Here you can really drill down into data over specific time pockets and gain a deeper understanding of how you’re meeting your targets. If you notice fluctuations in your ratios over a certain timeframe, you can get to the bottom of the ‘why’ and find actionable ways to rectify the situation with maximum innovation, confidence, and efficiency. In this instance, keeping your ratios consistently high - this essential KPI will help you do just that.

We offer a 14-day free trial. Benefit from professional CFO reports!

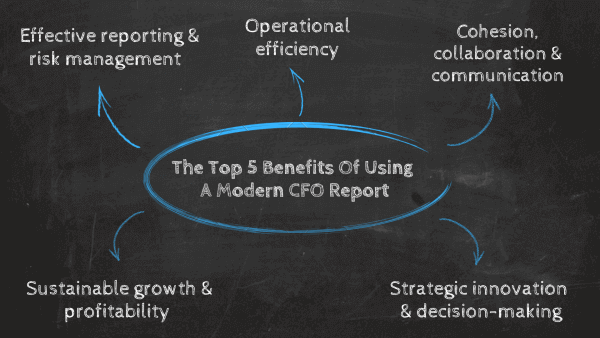

The Top 5 Benefits Of Using A Modern CFO Report

Now that we’ve delved into the inner workings of modern CFO dashboard KPIs and explored the practical value of these dynamic fiscal reporting tools, it’s time to shine a light on the benefits. Let’s take a look.

1. Effective reporting & risk management

First and foremost, a modern CFO report template is a robust and reliable means of effective financial reporting and risk management.

As a CFO, mitigating continual financial risk is a top priority - a responsibility that can make or break a business. By working with cutting-edge business dashboards, making swift, secure, and informed decisions becomes intuitive rather than daunting.

Serving up a cohesive mix of deep-dive past, predictive, and real-time data, CFO dashboard examples and reports will help you identify any potential issues or inefficiencies with ease, empowering you to nip them in the bud before they harm the financial health of the company.

2. Operational efficiency

In a sense, increased operational efficiency means reduced operational costs. The sheer scope of visual data served up by a CFO dashboard tool means you can keep an accurate handle on every core financial process across the organization.

Armed with the ability to quickly benchmark your success against previous months or years while mapping out your performance in a number of key areas, you can ‘trim the fat’ away from inefficiencies related to budget variance, capital, share value, reporting, labor management, and more. In turn, you will make the business more profitable, accelerating its financial growth year after year.

3. Cohesion, collaboration & communication

Any good fiscal report worth its salt is customizable, interactive, and displays essential fiscal metrics in an accessible way.

Moreover, by offering 24/7 access to dashboard data across multiple devices, online reporting software can empower financial decision-makers to develop strategies and monitor metrics wherever they are in the world.

This universal access to powerful information will improve collaboration and communication, boosting productivity across the board. This is one of the cornerstones of consistent professional growth and evolution.

4. Strategic innovation & decision-making

CFOs have to make big decisions, often on the spot. While once upon a time, senior financial leaders had to wade through droves of static spreadsheets and fiscal figures, today, it’s possible to drill down into relevant information and view it at a glance.

By gaining a panoramic snapshot of every one of your business’s critical financial operations and interacting with visualizations of a host of dynamic metrics, it’s possible to make informed real-time decisions with complete confidence. These are the kind of strategic choices that will benefit the growth of your company while avoiding potential financial calamities.

In addition to gaining added vision that will make you more effective in your role as a CFO, saving time and improving personal efficiency will give you more space to develop innovative initiatives and strategies to further boost the fiscal success of your business.

5. Sustainable growth & profitability

Expanding on our last point, gaining untapped access to a wealth of dynamic fiscal information means that you can tackle every one of your responsibilities with razor-sharp efficiency.

By saving time on sifting through numbers and metrics and working with a wide range of benchmarkable insights gained with professional data analysis tools, you will preserve your business’s fiscal health, keeping redundant costs to a minimum while discovering ways to improve revenue and attract valuable investors.

As a result, you will ensure sustainable growth while boosting your business’s profitability.

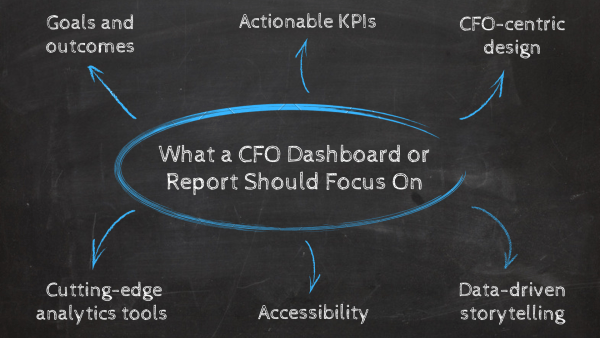

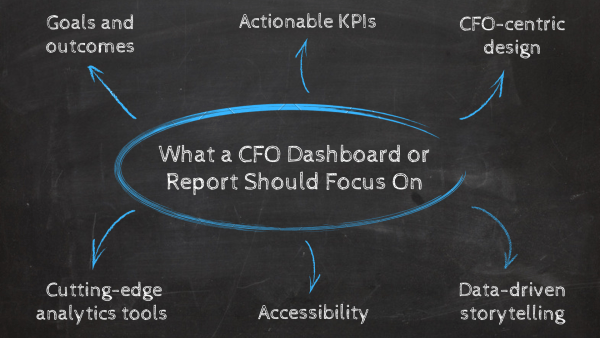

What a CFO Dashboard or Report Should Focus On

CFO-centric dashboards and CFO report templates work cohesively to deliver metrics and insights that will optimize your business's key fiscal activities in every area. To ensure you get the very best results from your analytical efforts on a sustainable basis, here’s what your CFO report or dashboard should focus on.

1. Goals and outcomes

First and foremost, your CFO KPI dashboard, or CFO dashboard tool, should contain your ultimate financial aims and goals. These organizational benchmarks will form the foundations of your analytical efforts, so it’s important that you take the time to consider them in detail. In this case, financial analytics software might help.

Sit down in a collaborative environment with your fiscal staff or other senior executives and discuss what you would like to achieve with your CFO KPI dashboard.

Do you want to drive down particular operational costs? Do you want to gain a better return on investment from your external investments? Do you need to monitor your payroll in more detail? Take the time to make these decisions, and you will be able to tailor your CFO dashboards for business intelligence.

2. Actionable KPIs

When it comes to reporting on finances, working with the right interactive KPIs is essential. Once you have set your aims, goals, and outcomes, you will be able to select CFO KPIs that will help you optimize your efforts.

Typical CFO KPIs offer a digestible visual representation of what matters most. By placing your focus on the right performance indicators, you will be able to evolve your business efforts exponentially.

Apart from looking at sales, costs, and other relevant financial data, CFOs also need to monitor the performance of other non-fiscal areas such as employee satisfaction in order to ensure the business's financial health. For this reason, your CFO dashboard should include a mix of actionable KPIs that will give an accurate picture and facilitate decision-making in all relevant areas. But remember, it is necessary to set actionable KPI goals and targets to be successful in the process.

3. CFO-centric design

One of the best things about modern data dashboards is the fact that you can tailor them to your preferences.

By customizing your dashboard and focusing on best design practices, you will make your data pop and ensure that everyone within the business can squeeze every last drop of value from the company’s budget-based data.

Our guide to dashboard design will steer you to chief financial officer report success.

4. Data-driven storytelling

Expanding on the previous point, the right reporting tool for your needs will not only follow core design principles but will also present a strong narrative.

Arranging your KPIs and designs in a way that follows a logical format (placed into a clear-cut beginning, middle, and end) will create a cohesive panoramic insight into specific financial aspects of your business while bringing your data to life. As humans, we’re storytelling creatures - as such - telling a tale with your visualizations will make your reports significantly more effective.

5. Accessibility

Another important consideration to make when it comes to this type of report is to ensure the right personnel within your organization have the right level of access to your reporting tools based on their role or analytical needs.

In addition to offering the right level of digital access, you should also focus on offering the right level of financial reporting training by hosting workshops. Doing so will ensure everyone is on the same page and can use your metrics to their full advantage. This is an important aspect to consider as financial objectives are usually influenced by multiple departments and areas of an organization.

6. Cutting-edge analytics tools

For true analytical success, it’s vital that you focus on working with the right tools for the job. For reaching a chief financial officer report success, here are the attributes your BI reporting tools should possess:

- The ability to tailor and customize your dashboards to your needs and preferences.

- An easy-to-navigate interface that is accessible from one central location.

- Visual, dynamic KPIs that will help you form long-term strategies and make decisions at a glance.

- Accessibility from a multitude of devices (including mobile) 24/7.

- Excellent user help and support.

By focusing on these key areas and working with the right tools, you will ensure that your CFO data analytics are a success from the outset.

We offer a 14-day free trial. Benefit from professional CFO reports!

Key Takeaways Of CFO Dashboards

We’ve explored the likes of a typical CFO monthly report template and CFO report example, journeyed through a range of dynamic CFO KPIs, glanced at the analytical benefits of modern business reporting, and there’s no denying it: as a chief financial officer, digital dashboards are your friend.

It’s clear that if you want to streamline your performance while accelerating the growth of your business, embracing the all-encompassing power and unrivaled analytical abilities of CFO-based data dashboards is no longer an add-on – it’s essential.

When you’re talking about your company’s finances, you cannot afford to miss a single beat. Your future depends on it. If you work with the most innovative tools for the job, you will lower costs, enhance profits, and streamline the operations of your business in ways you never thought possible. The future is now, the future is executive dashboards – don't get left behind.

If you’re ready to embrace the power of modern analytics and would like to level up your company’s fiscal management initiatives with modern solutions like datapine, sign up for our free 14-day trial and see what we can do for you.