2014 Q3 Funding Analysis of the Berlin Startup Scene

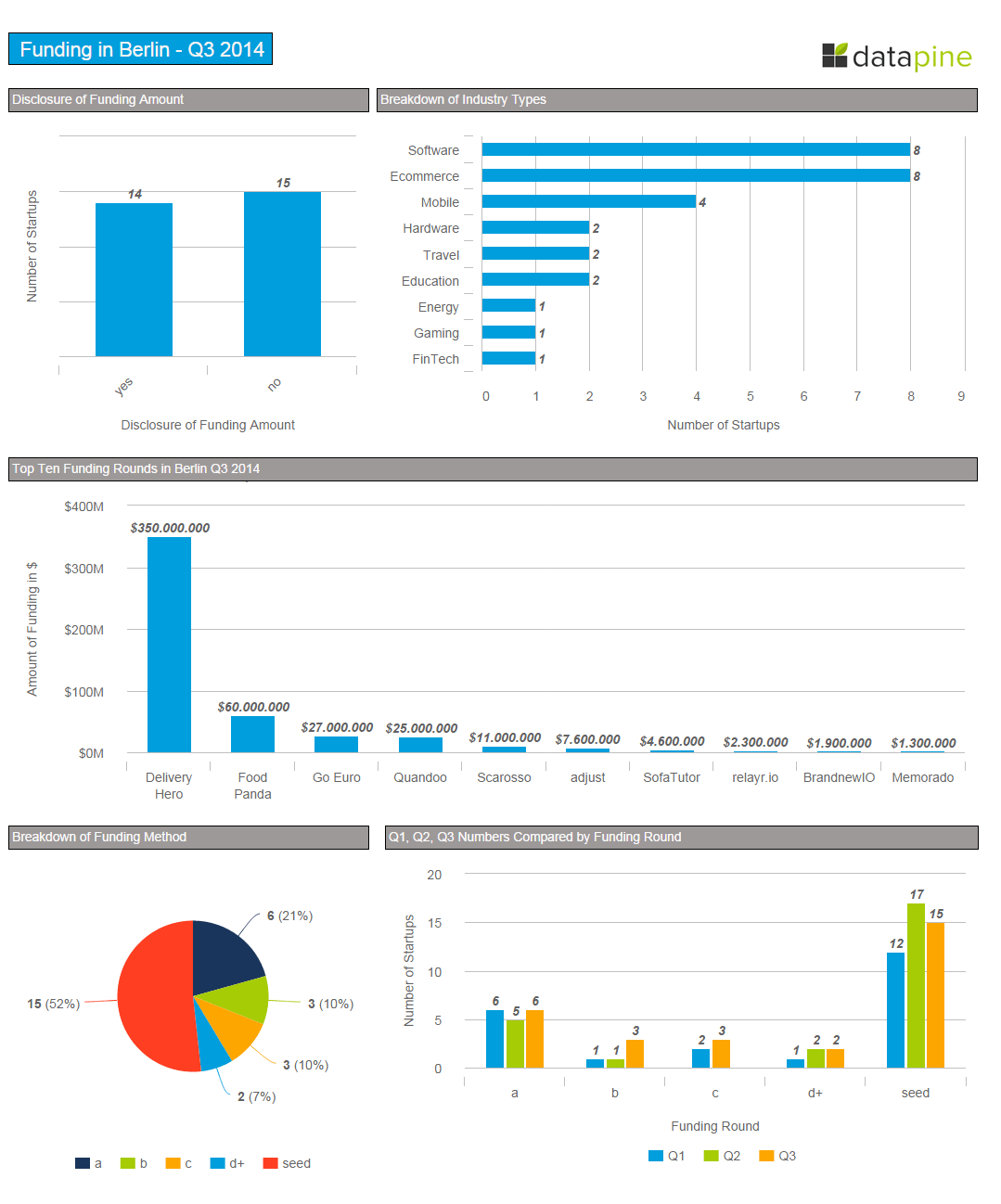

We’re back with our Berlin startup Q3 Funding Analysis! Want to brush up first? Don’t miss our Q1/Q2 report. What a quarter! With only fourteen of the twenty-nine startups that announced funding reporting exact numbers, Berlin saw close to $493M in investments in Q3, of which more than two-thirds came from Delivery Hero’s biggest round ever. Let’s dive in. Once again, our data was sourced first through CBInsights, then cross-referenced with press releases, Berlin blogs, and Crunchbase. Obviously, it is not perfect. If you spot an error or something we’ve missed, shoot an email to kalie@datapine.com and we promise to check it out. All data was analyzed and visualized with our data visualization and dashboard software.

We’re back with our Berlin startup Q3 Funding Analysis! Want to brush up first? Don’t miss our Q1/Q2 report. What a quarter! With only fourteen of the twenty-nine startups that announced funding reporting exact numbers, Berlin saw close to $493M in investments in Q3, of which more than two-thirds came from Delivery Hero’s biggest round ever. Let’s dive in. Once again, our data was sourced first through CBInsights, then cross-referenced with press releases, Berlin blogs, and Crunchbase. Obviously, it is not perfect. If you spot an error or something we’ve missed, shoot an email to kalie@datapine.com and we promise to check it out. All data was analyzed and visualized with our data visualization and dashboard software.Total Startups Funded and Total Acquisitions

Twenty-nine startups announced funding in Q3, which is slightly higher than both Q1 (27) and Q2 (26). There were four acquisitions of Berlin startups in Q3. Toroleo, a Project A company, was acquired by Delticom AG for an undisclosed price. The amount is thought to be small since it was recently reported that Toroleo had hit hard times and laid off twenty employees. Yukka, a big data startup, was acquired by Neunorm Verwaltungs GmbH, a private equity company, in an undisclosed deal. FontShop International GmbH was acquired by Monotype Imaging Holdings. The deal is structured as three transactions with an aggregate cash purchase price of approximately $13 million. SightIO, which builds computer vision technology for ranking photos, was acquired by another Berlin startup, EyeEm, for an undisclosed amount.Disclosure of Funding

Of the twenty-nine startups that received funding, only fourteen reported actual numbers. The number of startups that received funding was higher than in the previous quarters, but the number that disclosed funding amounts was considerably lower. In Q1 eighteen out of twenty-seven startups disclosed funding, and in Q2 eighteen out of twenty-six did.

Of the twenty-nine startups that received funding, only fourteen reported actual numbers. The number of startups that received funding was higher than in the previous quarters, but the number that disclosed funding amounts was considerably lower. In Q1 eighteen out of twenty-seven startups disclosed funding, and in Q2 eighteen out of twenty-six did.Breakdown of Industry Types

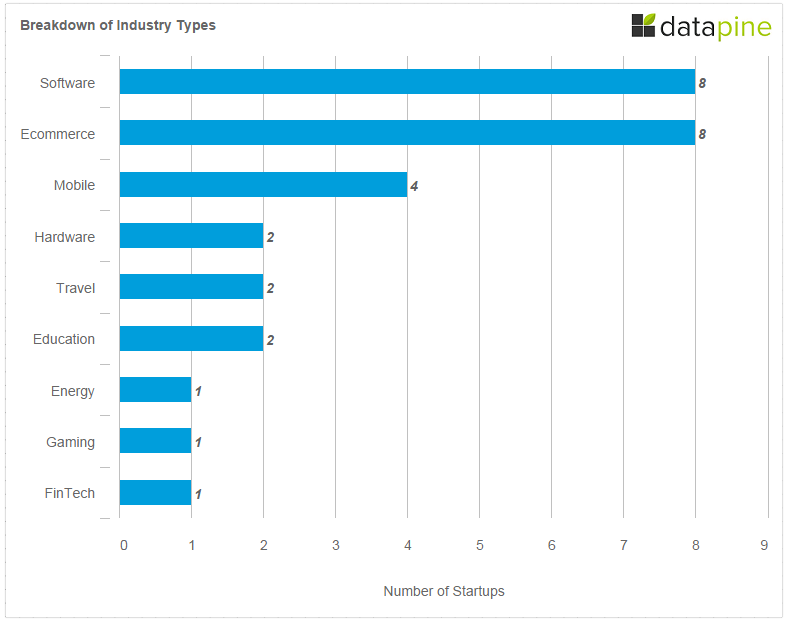

As is standard in Berlin, and consistent with Q1/Q2, most of the funded companies are ecommerce (8) and software (8) related. Those industries were followed by mobile (4), Hardware (2), Travel (2), and Education (2). The list is rounded out with one investment each in the Fintech, Energy, and Gaming industries.

As is standard in Berlin, and consistent with Q1/Q2, most of the funded companies are ecommerce (8) and software (8) related. Those industries were followed by mobile (4), Hardware (2), Travel (2), and Education (2). The list is rounded out with one investment each in the Fintech, Energy, and Gaming industries.Breakdown of Funding Method

The funding method breakdown follows the previous pattern. Fifteen companies received seed funding. Berlin saw six Series A rounds, three Series B, three Series C, one Series D, and one Series G.

The funding method breakdown follows the previous pattern. Fifteen companies received seed funding. Berlin saw six Series A rounds, three Series B, three Series C, one Series D, and one Series G.Top 10 Funding Rounds in Berlin Q3

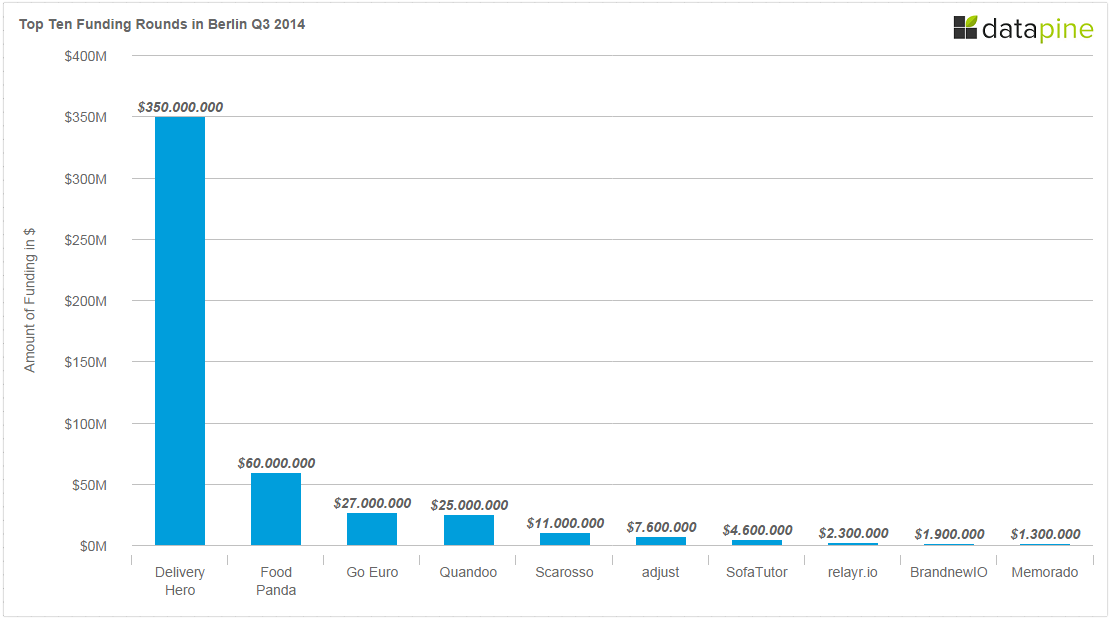

Delivery Hero was Berlin’s wunderkinder for Q1 and Q2 and again in Q3! They raised $88M in Q1, followed by $85M in Q2. In Q3 Delivery Hero announced their highest round ever, a $350M Series G round, bringing the total raised to $635M. Delivery Hero also made news in Q3 for acquiring competitor Pizza.de, bringing their total valuation over $1 billion. The online food delivery market keeps getting hotter. The second highest amount raised in Q3 goes to Rocket Internet’s FoodPanda with a $60M Series D round raised from existing investors. GoEuro raised $27 million in Series A funding led by New Enterprise Associates. Quandoo, an OpenTable competitor, announced a round of $25 million in Series C financing led by Piton Capital. Other investors in the round include Holtzbrinck Ventures, DN Capital, the Sixt family and Texas Atlantic Capital. Scarosso, a startup for high-end, handmade Italian shoes, raised a round of $11M. The investors are NEO Investment Partners, DN Capital, and IBB’s VC fond Kreativwirtschaft Berlin. Adjust (formerly Adeven), an app analytics startup, raised an additional $7.6M of funding from ACTIVE Venture Partners, and existing investors Target Partners, Iris Capital and Capnamic Ventures. SofaTutor raised a $4.6M round led by the school book publishing company Cornelsen and includes existing investors Acton Capital Partners, J.C.M.B. and IBB Beteiligungsgesellschaft. relayr, maker of the WunderBar, an Internet of Things (IoT) hardware dev kit which resembles a chunky chocolate bar, closed a $2.3M seed round from unnamed U.S. and Switzerland-based investors to increase their US expansion. Brandnew, a startup that helps brands create native ad campaigns for Instagram and Pinterest, raised a total of $1.9M in seed funding with $1.1M coming from a city grant. Memorado, a brain training games website created by two former Wimdu employees, received a $1.3M seed round from angels that include founders from Zalando and Hitfox.

Delivery Hero was Berlin’s wunderkinder for Q1 and Q2 and again in Q3! They raised $88M in Q1, followed by $85M in Q2. In Q3 Delivery Hero announced their highest round ever, a $350M Series G round, bringing the total raised to $635M. Delivery Hero also made news in Q3 for acquiring competitor Pizza.de, bringing their total valuation over $1 billion. The online food delivery market keeps getting hotter. The second highest amount raised in Q3 goes to Rocket Internet’s FoodPanda with a $60M Series D round raised from existing investors. GoEuro raised $27 million in Series A funding led by New Enterprise Associates. Quandoo, an OpenTable competitor, announced a round of $25 million in Series C financing led by Piton Capital. Other investors in the round include Holtzbrinck Ventures, DN Capital, the Sixt family and Texas Atlantic Capital. Scarosso, a startup for high-end, handmade Italian shoes, raised a round of $11M. The investors are NEO Investment Partners, DN Capital, and IBB’s VC fond Kreativwirtschaft Berlin. Adjust (formerly Adeven), an app analytics startup, raised an additional $7.6M of funding from ACTIVE Venture Partners, and existing investors Target Partners, Iris Capital and Capnamic Ventures. SofaTutor raised a $4.6M round led by the school book publishing company Cornelsen and includes existing investors Acton Capital Partners, J.C.M.B. and IBB Beteiligungsgesellschaft. relayr, maker of the WunderBar, an Internet of Things (IoT) hardware dev kit which resembles a chunky chocolate bar, closed a $2.3M seed round from unnamed U.S. and Switzerland-based investors to increase their US expansion. Brandnew, a startup that helps brands create native ad campaigns for Instagram and Pinterest, raised a total of $1.9M in seed funding with $1.1M coming from a city grant. Memorado, a brain training games website created by two former Wimdu employees, received a $1.3M seed round from angels that include founders from Zalando and Hitfox.Q1, Q2, Q3 Numbers Compared by Round

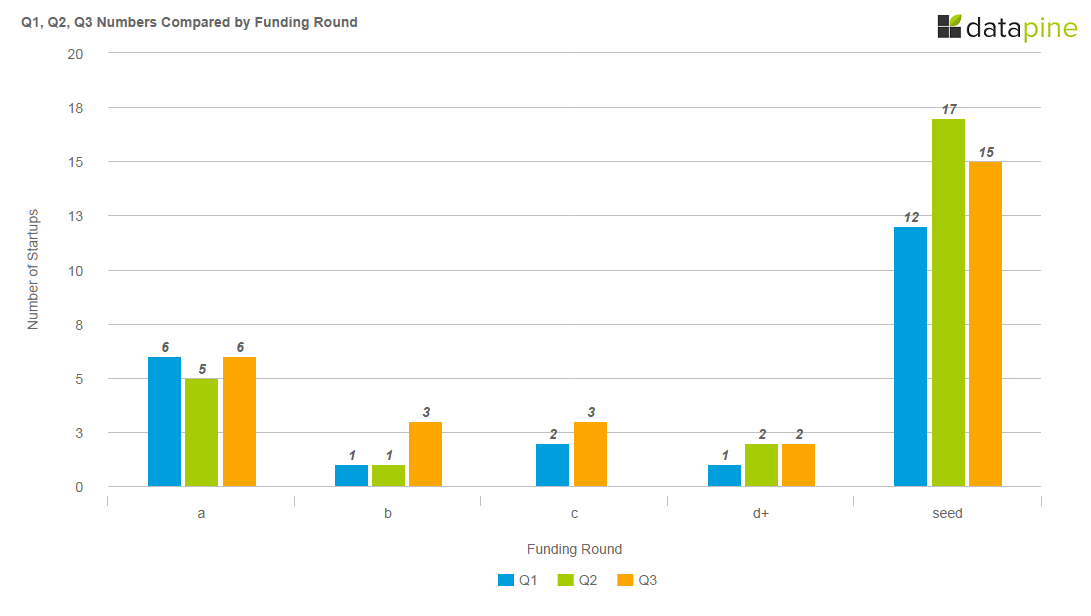

When it comes to the distribution of rounds the quarters are very similar. Please note, the chart is slightly biased. In Q1 there were five startups that raised funds where a round was not identified (or was crowdfunded), and in Q2 there was one unknown round.

When it comes to the distribution of rounds the quarters are very similar. Please note, the chart is slightly biased. In Q1 there were five startups that raised funds where a round was not identified (or was crowdfunded), and in Q2 there was one unknown round.